Last week, I watched two thought-provoking podcasts from well-known investors: Raoul Pal, a crypto and blockchain expert, and Jaspreet Singh, a savings and investment guru. If you’re familiar with the investing world, their names likely ring a bell. Both bring compelling yet drastically different perspectives on the future of investing. This has sparked me to reflect on my own investment journey as I look to 2025.

Investment Strategies: Crypto vs. Real Estate

Raoul Pal:

- Focus on Crypto & Blockchain: He strongly believes that cryptocurrencies like Bitcoin and Ethereum will outperform traditional investments, as they are part of a broader shift to a “digital economic era.”

- Emphasizing Innovation: Raoul advocates for investing in cutting-edge technologies such as AI and robotics, which will drive productivity and transform industries.

Jaspreet Singh:

- Cash Flow Investments: Singh emphasizes cash-flow-generating assets, like rental real estate and dividend-paying stocks, criticizing speculative assets like crypto for their volatility.

- Critiques Conventional Investments: He challenges the notion of investing in primary residences, explaining the hidden opportunity costs and lower short-term returns.

My Personal Investment Journey: Building a Balanced Portfolio

Reflecting on my own portfolio, which spans across startups, stocks, crypto, and real estate, I can appreciate how each investment has contributed to my financial growth—and setbacks.

1. Startups:

While I’ve invested in several promising ventures, the startup sector has been the least profitable for me. Although some were exciting at first, none have yet yielded a return.

2. Stocks (ETFs and Individual):

- ETFs: My ETF investments have done well, with a compound return of 54% since 2020 (as of November 2024).

- Individual Stocks: Unfortunately, my individual stock picks have been a mixed bag. Some poor decisions and lack of throrough research led to significant losses, a lesson I now take seriously. (Read more about that here)

3. Crypto:

- Altcoins: Much like my individual stock picks, my altcoin investments were a disaster. I failed to do proper research and let greed cloud my judgment, holding on when I should have taken profits. (More on that here)

- Bitcoin: On a more positive note, Bitcoin has been the STAR performer in my crypto portfolio, delivering consistent gains. This year, my extra purchases at the beginning of the year have delivered about 85% return, and earlier investments have surely more than doubled.

4. Real Estate:

Real estate has proven to be my second-best investment class, after Bitcoin. It’s delivered solid rental yields of 14-20%, with impressive capital appreciation of up to 40%. What truly sets real estate apart is its ability to generate consistent monthly rental income, something no other asset in my portfolio can match. This reliable cash flow has allowed me to reinvest in more properties and Bitcoin, diversifying my portfolio further. (Read more about my real estate investment journey here)

Effort vs. Return: Why Bitcoin Outperforms Real Estate Investments in 2024

When comparing effort versus return, Bitcoin is the clear winner for me. The beauty of Bitcoin is its simplicity—buy and hold. There’s minimal effort involved, and I don’t have to constantly monitor every move in the market. It’s straightforward, low maintenance, and incredibly rewarding over time. In fact, none of my real estate investments have doubled their capital so quickly as Bitcoin has.

Real estate, while rewarding, demands more work. It’s far from passive, as many people assume. Choosing the right country, city, location, and price takes significant time and resources. Once you’ve secured a property, renovations and finding tenants (whether long-term or short-term) follow. Even with a property manager, issues arise frequently.

You might argue that Bitcoin is risky and volatile—and you’re right, it certainly carries its own risks. But the truth is, every type of investment comes with risks. Not every property will bring you high rental yields or great appreciation over time. I have friends who invested in real estate in cities like Toronto, Budapest, and Georgia, and they’re now facing the harsh reality of low rental income that barely covers their mortgage payments. Some have even seen their off-plan projects stall, with unfinished developments and occupancy rates that barely make a dent.

The reality is that all investments, whether crypto or property, require careful research, proper timing, and the ability to adapt to changing conditions.

Real Estate vs Crypto: Which is the Better Investment for 2025?

My fiancé and I recently found ourselves grappling with the same question: Where should we invest in 2025? The answer, as it turns out, isn’t straightforward. Just as there are countless ways to reach Rome, there are countless paths to building wealth.

While we both share a deep passion for investing, our approaches couldn’t be more different. Our risk appetites, asset preferences, and outlooks on the market frequently lead to fascinating (and sometimes heated) debates.

Take, for example, our views on emerging markets. He would never consider investing in countries like Cambodia, Vietnam, or Kenya. Whenever I bring up a new investment opportunity, his first question is always, “Where did you even find these opportunities? How on earth?” His disbelief always makes me smile and serves as a reminder of just how different we are. It also makes me realize that I’m still the same person with a taste for adventure—whether in travel or investing. I follow my own path and let my heart guide me in exploring what feels right.

In my own experience, I’ve seen both successes and failures. For example, I once believed in certain altcoins, but I’ve since learned not to invest in them again. It’s not that altcoins are inherently bad, but I’ve chosen to focus my attention elsewhere. On the flip side, my fiancé remains a strong believer in altcoins, convinced they’ll play a key role in shaping the future of finance, despite their volatility.

One thing we both agree on: crypto has been the best-performing asset in our portfolio. But the big question remains—will crypto still be the best investment in 2025? That’s where the debate gets interesting.

Real Estate: Fulfillment Beyond Financial Returns

For me, real estate offers something Bitcoin can’t: a deeper sense of fulfillment. While crypto is undeniably efficient and passive, real estate is an adventure of the mind. I love diving into the research—exploring markets, uncovering hidden opportunities, and connecting with people from all walks of life. It’s a process that fuels my curiosity and keeps me engaged.

Real estate isn’t just about financial returns; it’s about personal growth. Each investment is a journey of learning, adapting, and problem-solving. Whether it’s navigating zoning regulations, assessing market trends, or overcoming unexpected challenges, the process is rewarding in ways that go beyond money.

Entrepreneurship: My Fiancé’s True Calling

For my fiancé, the fulfillment I find in real estate mirrors his passion for building his startup. Despite its early-stage struggles, his company gives him a sense of purpose that no other investment could replicate. The challenges of entrepreneurship—solving complex problems, driving innovation, and building something from scratch—are what fuel his passion. For him, the journey itself is the reward, even if the financial returns take time.

Investing: A Game of Growth and Discovery

Even if I had all the wealth in the world, I wouldn’t stop investing. In fact, I’d dive into even more unconventional opportunities—like creating a remote digital nomad retreat or investing in infrastructure projects in Africa, an idea I’ve been mulling over for years.

For me, investing isn’t just about reaching a financial target; it’s about the journey itself—the excitement of venturing into uncharted territory, tackling new challenges, and learning from every experience along the way. Investing is more than a strategy; It’s a game of strategy, resilience, and discovery that I never tire of playing.

The more I invest in real estate, the richer my experiences become. Every project teaches me something new, and these lessons are what fuel the content I share on my blog. It’s a self-sustaining cycle where my journey as an investor feeds my writing, and my writing, in turn, inspires even more exploration in my investments.

This is why, despite Bitcoin outperforming every other asset in my portfolio, I keep coming back to real estate. It isn’t just about the returns; it’s the way it fuels my curiosity, mental thrills, and thirst for adventure.

In many ways, it’s my own unique path to Rome—a journey that’s entirely mine, leading me to something far more meaningful than just wealth.

Looking Ahead to 2025: My Investment Strategy

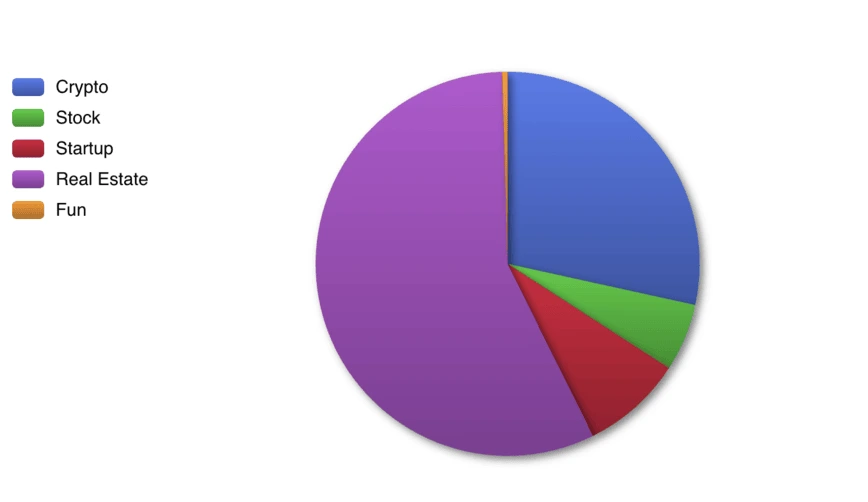

As I step into 2025, I’ve decided to anchor my investments around two core pillars: Real estate and Bitcoin. My allocation will look like this:

- 65% in Real Estate: The foundation of my portfolio, offering stability and consistent returns.

- 25% in Bitcoin: The ultimate growth driver, balancing high potential with my risk tolerance.

- 10% for Fun and Exploration: A small allocation for unique opportunities or experiments that excite me.

I won’t be adding anything new to stocks, startups, or altcoins unless a truly extraordinary opportunity arises.

Tips for Different Types of Investors

- If You’re Starting with Limited Capital

- Start small but steady with dollar-cost averaging (DCA) into Bitcoin. This beginner-friendly strategy lets you build exposure over time, starting with as little as $1. It’s a great way to ease into investing without feeling overwhelmed. For a detailed guide, check out this blog.

- If You’re an Adventurous and Experienced Investor and Risk-Taker

- You probably already know how to navigate the thrills of investing. Stick to what drives you, and trust your instincts to seek out high-potential opportunities.

- If You Have Wealth but Prefer Stability

- A balanced portfolio is your key to peace of mind. Invest 80% in diversified ETFs like the S&P 500 or All-World ETF for long-term, stable growth, and allocate 20% to Bitcoin for its promising upside. This strategy offers the perfect mix of safety and opportunity

- If You’re Seeking Rental Income and Don’t Mind Extra Effort

- Real estate is a smart choice for generating monthly passive income while growing wealth. Though it demands more work, the potential rewards are substantial. Use rental earnings to reinvest in stocks or crypto, or refinance properties to expand your portfolio strategically

P.S. Whether you’re new to investing or already have some experience, I highly recommend reading my blog post about how I lost nearly a million US dollars across different investments. It’s a raw, honest reflection of the mistakes I made—packed with valuable lessons that could save you from making the same errors.

Final Thoughts: A Personal Journey

Keep in mind that the reflections shared here are purely my own. I’m not a financial advisor, and I strongly recommend doing your own research or consulting with a professional before making any investment decisions.

For me, investing has always been about continuous learning, growth, and embracing the challenges that come with each opportunity. My experiences—both the successes and the failures—have shaped my approach, and I’ve come to understand that there’s no one-size-fits-all path to wealth. What works for me might not work for you, and that’s perfectly okay.

Whether you’re drawn to the simplicity and potential of Bitcoin, the adventure of real estate, or something else entirely, the best investment is the one that aligns with your core values, your ambitions, your experience, and your time and financial resources.

At the end of the day, your journey—your path to Rome—is uniquely yours to define. I hope that, no matter where it leads, it brings not only financial growth but also a deeper sense of personal fulfillment and purpose.

Happy New Year 2025 & Happy Investing!

Related posts:

Offshore Companies & Tax Evasion (6 Chapters)

Offshore Companies & Tax Evasion (6 Chapters)

How to Invest in Cambodian Real Estate as a Foreigner: My Personal Experience as a European Investor

How to Invest in Cambodian Real Estate as a Foreigner: My Personal Experience as a European Investor

How to Start Investing in Crypto with Just $1: A Beginner’s Guide

How to Start Investing in Crypto with Just $1: A Beginner’s Guide

No Proof, No Problem: Top 5 Countries for Property Investment Without Financial Disclosure in 2025

No Proof, No Problem: Top 5 Countries for Property Investment Without Financial Disclosure in 2025

Nairobi Real Estate Investment 2025: How I Bought 2 High-ROI Apartments for Under $150K

Nairobi Real Estate Investment 2025: How I Bought 2 High-ROI Apartments for Under $150K

Vietnam Real Estate Investment 2025: Critical Risks, New Regulations & Insider Tips for Foreign Investors

Vietnam Real Estate Investment 2025: Critical Risks, New Regulations & Insider Tips for Foreign Investors