1. United Arab Emirates (UAE) 🇦🇪

Unique Features:

- No personal income tax, no capital gains tax, and no withholding tax.

- Corporate Tax: 9% for taxable income exceeding AED 375,000 (above €94,000) (effective June 1, 2023).

- Domestic Minimum Top-up Tax (DMTT): 15% tax for multinational enterprises (MNEs) with global revenues above €750 million (effective January 1, 2025).

- Free Zones: 0% tax for qualifying businesses in designated free zones if they comply with regulatory requirements and do not conduct business with UAE mainland.

- Banking Privacy: Strong financial system but strict compliance rules for non-residents.

Advantages:

✔ Tax Benefits: 0% tax in free zones for eligible companies.

✔ Wealth Protection: No personal income tax, no foreign exchange controls.

✔ Strategic Location: Ideal for Middle East, Africa, and Asia.

✔ Strong Banking System: Access to multi-currency accounts.

Disadvantages:

✖ New 9% Corporate Tax: Some companies now subject to taxation.

✖ Substance Requirements: Some free zones require office space.

✖ Strict Banking Rules: Harder for non-residents to open accounts.

2. Singapore 🇸🇬

Unique Features:

- Corporate Tax: 17%, but effective tax can be reduced to 5%-8% through exemptions.

- No tax on foreign-sourced income that is not remitted to Singapore. 👉 (Remember this, as it will be relevant later in this blog.) ‼️

- Strong Banking: Internationally recognized financial hub.

- Reputation: Business-friendly, compliant with OECD standards.

Advantages:

✔ Low Taxes: Tax incentives for startups and regional HQs.

✔ Global Banking Access: Easy access to multi-currency accounts.

✔ Stable Economy: Safe for long-term wealth preservation.

✔ Strong Legal Framework: Based on English common law.

Disadvantages:

✖ Stricter Compliance: Tough KYC (Know Your Customer) rules for banking.

✖ High Costs: Expensive office rentals and labor costs.

✖ Corporate Transparency: Public financial filings required.

3. Cayman Islands 🇰🇾

Unique Features:

- No corporate income tax, no capital gains tax, and no withholding tax.

- Popular for offshore investment funds, trusts, and wealth preservation.

- Banking Privacy: Shareholders and directors are not publicly disclosed.

Advantages:

✔ Zero Taxes: Ideal for asset holding and investment funds.

✔ Strong Legal Protection: British common law-based legal system.

✔ No Public Disclosure: Complete privacy for company owners.

✔ Fast Incorporation: No residency requirements for directors.

Disadvantages:

✖ Perception Issues: Under scrutiny as a tax haven.

✖ Banking Challenges: Harder to open accounts due to global compliance rules.

✖ High Setup Costs: Expensive incorporation and compliance fees.

✖ Limited Substance: Some tax authorities may require proof of real business activity.

4. Switzerland 🇨🇭

Unique Features:

- Corporate Tax Rate: Varies by canton, ranging from 11% to 21%.

- World-class banking system with strong asset protection.

- Stable Political and Economic Environment: Ideal for wealth storage and investment.

Advantages:

✔ Top-Tier Banking: Secure and reputable wealth management.

✔ Stable Economy & Legal System: Low risk for long-term investments.

✔ Low Effective Tax Rate: Can be reduced with deductions and incentives.

✔ Ideal for Holding Companies: Popular for multinational businesses.

Disadvantages:

✖ High Setup & Maintenance Costs: Expensive company incorporation and banking.

✖ Strict Regulations: Tough compliance requirements for financial services.

✖ Banking Restrictions: Swiss banks are selective about clients.

✖ EU Pressure: Switzerland faces increasing scrutiny on tax transparency.

5. Hong Kong 🇭🇰

Unique Features:

- Corporate Tax Rate:

- 8.25% on the first HKD 2 million of assessable profits.

- 16.5% on assessable profits exceeding HKD 2 million.

- Territorial Tax System: Only Hong Kong-sourced income is taxable, foreign income is exempt.

- Strong Financial Sector: A major gateway to China and Asia.

Advantages:

✔ Low Taxes: No tax on foreign-sourced income.

✔ Global Banking Hub: One of the best for multi-currency business accounts.

✔ Easy Incorporation: Fast and efficient setup (1-2 days).

✔ Strong Legal Framework: British common law-based system.

Disadvantages:

✖ Political Risks: Growing influence from China raises long-term concerns.

✖ Stricter Compliance: Banks require extensive due diligence.

✖ Banking Challenges for Foreigners: Harder to open accounts for non-residents.

✖ Corporate Transparency: Ultimate Beneficial Owners (UBOs) must be disclosed.

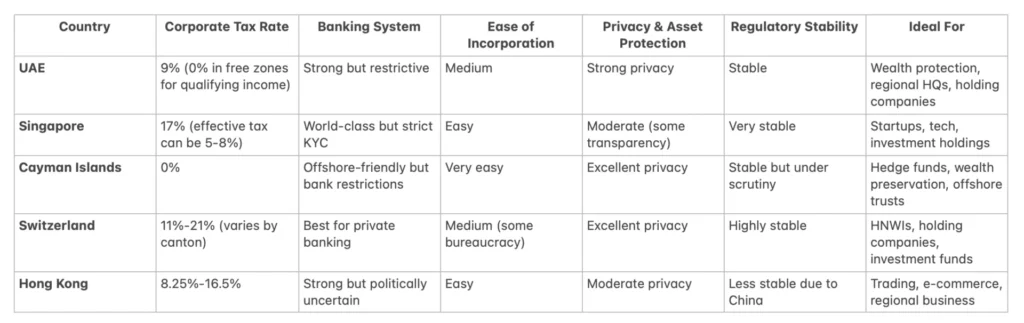

Comparison Table: Best Countries for Company Incorporation & Wealth Holding (2025)

Which Country Should You Choose?

Which Country Should You Choose?

- For Zero-Tax Holding Companies: Cayman Islands or UAE (free zones).

- For Low-Tax Reputable Business Structures: Singapore.

- For Wealth Protection & Private Banking: Switzerland.

- For International Trade & E-commerce: Hong Kong.

- For Middle East Expansion & Asset Holding: UAE

Best Overall Choice (2025)?

- Singapore offers the best combination of low taxes, business reputation, and global banking access.

- Cayman Islands & UAE remain top choices for wealth preservation and tax efficiency.

- Switzerland is unbeatable for banking security and asset protection.

Why Singapore is the Best for My Small to Medium-Sized Businesses

I must highlight ‘With the Majority of Revenues Generated Outside of Singapore’ because, as mentioned earlier, foreign-sourced income is not taxed unless it is remitted to Singapore. This makes Singapore an exceptionally attractive jurisdiction for businesses that operate globally.

Having incorporated companies in almost all the countries listed above, I’ve experienced the entire process firsthand—from setup to banking, compliance, and global operations. Singapore stands out as my top choice.

Yes, Singapore’s KYC process is strict, but for good reason. It upholds high regulatory standards, ensuring that its financial system remains one of the most secure and globally respected. While the initial setup takes some effort, once established, you gain access to an internationally recognized banking ecosystem that makes global transactions seamless and business operations effortless.

Beyond regulatory strength, Singapore is also one of the most cost-effective jurisdictions on this list. Incorporation and banking costs are significantly lower than in Switzerland or the Cayman Islands—yet without the reputation risks associated with offshore tax havens. It offers the best of both worlds: tax efficiency and international credibility.

For me, Singapore offers the ultimate balance of business efficiency, financial strength, global accessibility, and credibility—making it my go-to jurisdiction for incorporation.