If you could go back 7–12 years and invest in booming Asian cities like Ho Chi Minh or Bangkok before prices skyrocketed, would you? That’s exactly how I see Nairobi today.

For years, I had my eye on Africa. I watched documentaries about how Chinese businesses were making massive moves across the continent, and I thought—I wish I could do the same. The problem? Finding the right entry point.

Fast forward nearly a decade, and that moment finally arrived. Through a series of unexpected connections—three different people, each telling me they felt ‘sent by God’ to assist me—I found myself at the doorstep of Kenya’s real estate market. Coincidence? Maybe. But some opportunities don’t knock twice.

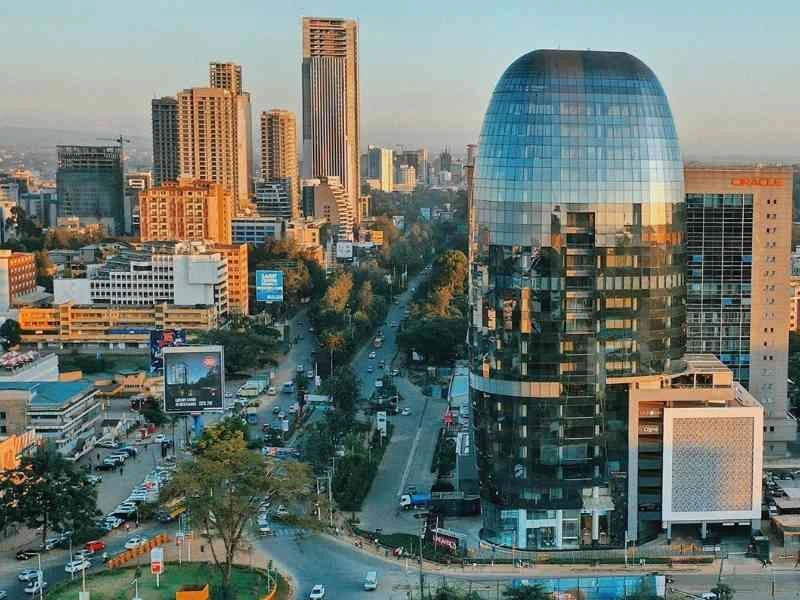

And I wasn’t wrong. Nairobi’s energy, rapid development, and sheer potential confirmed my instincts—this is where opportunity lies.

I get it—Africa isn’t on every investor’s radar. Some see opportunity; others see risk. But if you’re even a little curious, keep reading—you might just change your mind.

In this post, I’ll break down why Nairobi is becoming a real estate hotspot, the impact of Chinese investments, and how I secured two high-yield rental units in Kenya’s capital.

P/S: If you haven’t read my first blog about Kenya yet, you can read it here. Then you’ll understand why Nairobi caught my attention.

Why Invest in Nairobi? Key Economic & Real Estate Facts

Kenya at a Glance

- Population: ~54 million (2024 estimate)

- Nairobi Population: ~5.5 million (likely higher in reality)

- GDP Growth: 5% (2024 estimate)

- Main Industries: Agriculture, tourism, finance, tech, and manufacturing

- Challenges: Unemployment (~12%), high public debt (~70% of GDP), corruption

- Opportunities: Growing middle class, digital economy expansion, infrastructure investments

Nairobi, as East Africa’s financial and tech hub, is leading Kenya’s economic growth. It’s where innovation, foreign investment, and real estate demand intersect, making it one of Africa’s most attractive investment destinations.

(Source: WorldBank)

Why I’m Investing in Nairobi Real Estate

1. A Young, Rapidly Growing Population

Kenya has a median age of just 19.9 years, with a high fertility rate of 3.2 children per woman. Nairobi’s urbanization is accelerating as more people move to the city for education and job opportunities. By 2040, the city’s population is expected to exceed 7 million, creating consistent demand for residential and commercial real estate.

(Source: Statista)

2. A City Full of Energy, Safety, and Investment Potential

Nairobi exudes an energy that you can only truly understand when you experience it firsthand. During my time in the city, I spoke with both local and foreign business owners, and one theme was consistent—optimism. Everyone I met is doubling down on their investments, a clear testament to Nairobi’s long-term potential. Not once did I encounter someone planning to leave.

Even before setting foot in Kenya, I spent hours consuming expat stories and investment case studies, and the sentiment was always the same—Nairobi is a city on the rise.

But what struck me most was a new trend: Kenyans returning home after years abroad. Rather than just investing remotely, they are choosing to live in Nairobi again. This shift signals more than just economic growth—it reflects increasing stability, confidence, and opportunity in the city’s future.

3. Affordable Real Estate with High Rental Yields

Nairobi offers a rare combination of low property prices and high rental yields.

- Average rental yield: 5–10% (prime areas like Westlands, Kilimani, and Kileleshwa offer 8–10%)

City Centre Apartments

- Price per Square Meter: KSh 215,000 (~$1,665 USD)

- Price per Square Foot: KSh 20,926.50 (~$162 USD)

Outskirts of the City:

- Price per Square Meter: KSh 124,000 (~$960 USD)

- Price per Square Foot: KSh 12,070.61 (~$93.50 USD)

Source: Numbeo

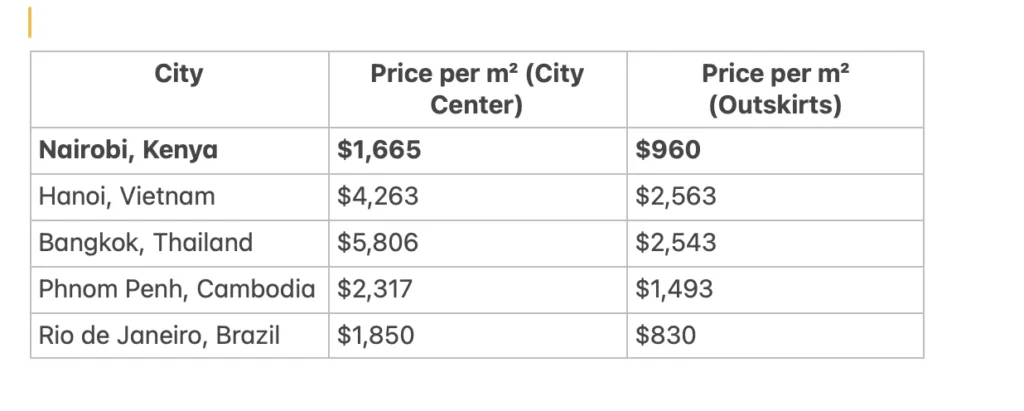

How Nairobi Compares Globally

Compared to fast-growing cities worldwide, Nairobi real estate is still undervalued—offering high-growth potential for early investors.

My Investment: A Real Case Study

I purchased two luxury apartments in Westlands, Nairobi’s most sought-after district:

Unit 1: 69 m² (~742.7 ft²) – $69,697 (2-bedroom)

- $1,010/m²

- $93.86/ft²

Unit 2: 62 m² (~667.36 ft²) – $64,276 (1-bedroom)

- $1,036/m²

- $96.35/ft²

These units are in a modern building with premium amenities: a gym, pool, kids’ playroom, meeting rooms, and a rooftop BBQ area. Expected completion: June 2027.

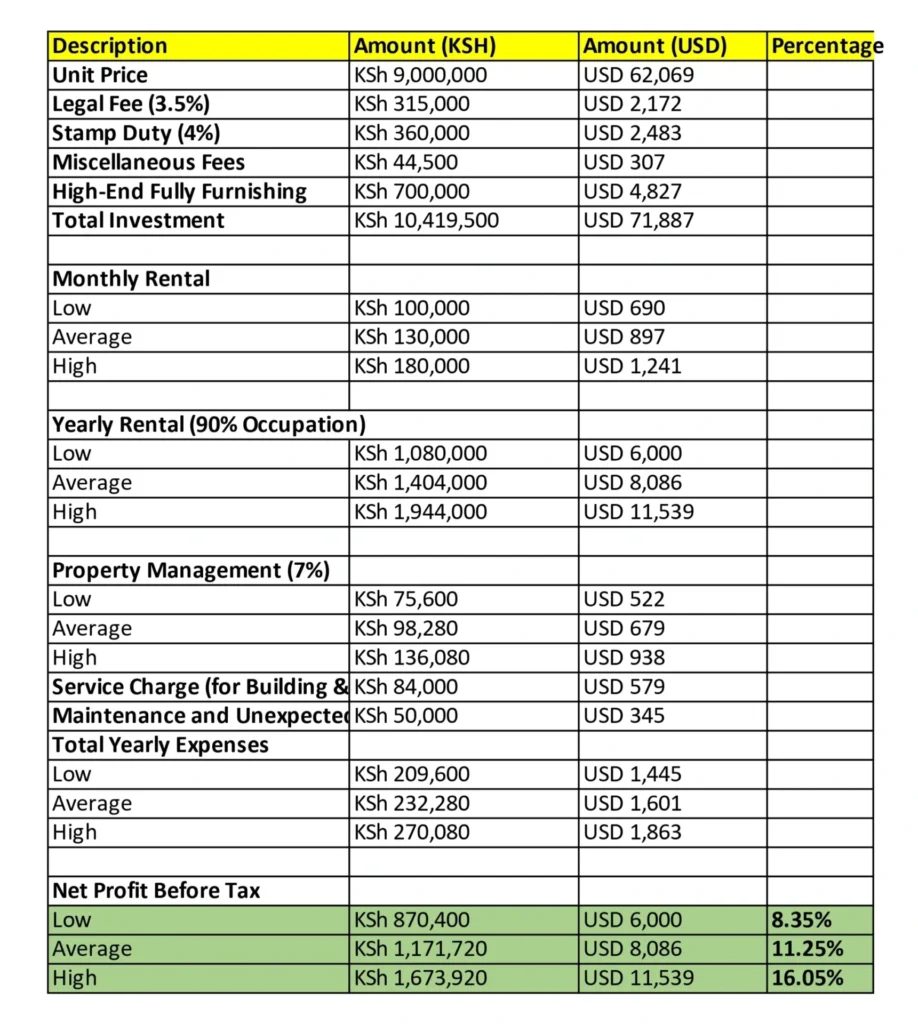

These Are The Rental Return Projections in 3 Different Scenarios 🏡💰 LOW, AVERAGE, AND HIGH

These projections show that no matter the scenario, the returns on investment in Nairobi’s real estate market are highly promising.

4. Flexible Payment Plans with No Interest

One of the biggest advantages of investing in Nairobi real estate is the availability of installment payment plans for off-plan projects. Unlike completed buildings, where you need to pay the full amount upfront, off-plan purchases offer more flexibility and lower entry costs.

With just a 20% down payment, I can secure a property at a lower price than a completed unit of the same quality and size. The remaining balance is spread out into monthly or quarterly payments—interest-free—directly to the developer.

This approach gives me two key advantages:

✅ Less financial strain—I don’t need to have the full amount upfront.

✅ Lower risk exposure—If the project is delayed, postponed, or remains unfinished, I haven’t tied up all my capital in one go.

5. Flexibility and Ease of Doing Business

Nairobi offers a transparent, investor-friendly regulatory environment, making it one of the easiest cities in Africa for real estate investment. With no capital controls and straightforward foreign property ownership, the city presents a welcoming atmosphere for investors.

Besides, it’s not difficult to find highly skilled and reliable professionals in any aspect of investment—real estate agents, lawyers, and property managers.

6. Chinese Investments Strengthen My Case for Nairobi

One of the strongest indicators of a high-potential market is where Chinese investors put their money. They are known for for their sharp insights and calculated risks. Their presence in Kenya reinforces my belief that this is a market worth entering.

With a staggering $1.8 billion in Chinese Foreign Direct Investment (FDI), Kenya ranks as the #6 African nation receiving Chinese funds (Source: Statista). This influx of capital is driving massive infrastructure projects across the country, including roads, railways, affordable housing, and power plants—key elements in transforming Nairobi into an economic powerhouse.

During my time in Nairobi, I couldn’t ignore the strong Chinese presence—from signage to entire buildings equipped with Chinese-made materials. In my apartment building, nearly everything—from the gym equipment to elevators, doors, and appliances—was made in China, signaling the deep level of investment. There is even a big China Town there.

More importantly, similar to other business owners I spoke to earlier, the Chinese entrepreneurs I met also have no plans to leave. They view Nairobi as a goldmine, full of untapped opportunities to build wealth. If they are betting on Nairobi’s future, I see no reason why I shouldn’t.

Best Neighborhoods to Invest in Nairobi Real Estate

1. Westlands (My Investment Choice) ✅

Westlands is one of Nairobi’s most sought-after areas, blending commercial and residential opportunities. The demand for office spaces and high-end residential properties is rising, making it attractive for expatriates, business professionals, and young professionals. The area also boasts a variety of restaurants, shopping malls, and entertainment hubs, ensuring there’s always something happening.

My Verdict: I’ve already bought two apartments in Westlands, and that speaks volumes about the area’s potential. It’s the heart of Nairobi. Everything you could possibly need—from dining to entertainment—is right at your doorst

2. Kilimani

Kilimani is a well-established residential area, popular with young professionals, expatriates, and families. Its proximity to the Nairobi CBD, along with its lively social and retail scene, makes it an attractive location for residential properties.

My verdict: Kilimani can be a hit or miss depending on the location and the developer. I’ve stayed in an apartment here and appreciated how convenient it was to everything—restaurants, malls, and even just walking around. However, the area suffers from constant traffic congestion, especially during peak hours, and there’s an influx of new developments, which could lead to oversupply in the future. If you’re investing here, do your homework on the location and developer.

3. Riverside Drive

Riverside Drive is a prime location offering a mix of high-end residential properties and commercial real estate. Its green, peaceful atmosphere makes it attractive to expatriates, diplomats, and professionals. The area’s proximity to the CBD and international organizations adds to its desirability.

My verdict: I really, really like this area. It’s green, walkable, and very breathable, with large shopping malls, supermarkets, and entertainment venues nearby, making it a highly enjoyable place to live. However, I haven’t been able to find a project that meets my expectations. The high price per square meter, combined with the obstructed views from buildings packed closely together, which leave little room for great vistas, just doesn’t justify my investment here.

4. Lavington & Karen

Both are upscale, family-friendly areas with peaceful environments and large homes, popular among wealthy families and expatriates. Less suited for short-term rentals or urban investments.

My verdict: Great for families, but not aligned with my strategy focused on rental yield and urban convenience. Ideal for long-term, luxury investments. Excellent for family-focused investments but less appealing for high-yield rental strategies.

If I Had $500,000 or More, This Is How I’d Scale My Investment in Nairobi

I wouldn’t focus on the luxury condo market. Instead, I’d partner with a Chinese developer to build high-quality residential properties targeting the middle class—a sector with strong and ongoing demand.

- Rental prices for this segment range between KSh 50,000–150,000 ($344.83–$1,034.48)

- This market is underserved, making it a compelling investment opportunity with steady demand.

Beyond financial returns, this strategy solves a national issue—the housing shortage—while ensuring safe, high-quality homes for many.

The investment becomes more meaningful when it generates strong profits and creates a positive impact.

Additionally, government incentives like tax breaks or exemptions could further enhance profitability, making this an even more attractive long-term play.

Ending Note

👉 In my next post, I’ll dive into the risks investors should be aware of before entering Nairobi’s real estate market. Stay tuned! 💪🥳

Related posts:

How I Invested in 2 Profitable Businesses in Nairobi For Under $50K | Kenya Investment Guide

How I Invested in 2 Profitable Businesses in Nairobi For Under $50K | Kenya Investment Guide

How to Invest in Cambodian Real Estate as a Foreigner: My Personal Experience as a European Investor

How to Invest in Cambodian Real Estate as a Foreigner: My Personal Experience as a European Investor

Vietnam Real Estate Market 2025: Why Ho Chi Minh City is the Best Investment Hotspot for Foreign Buyers

Vietnam Real Estate Market 2025: Why Ho Chi Minh City is the Best Investment Hotspot for Foreign Buyers

Real Estate Insights: My 2-Week Investment Journey in Ho Chi Minh City (Sept 2024)

Real Estate Insights: My 2-Week Investment Journey in Ho Chi Minh City (Sept 2024)

Nairobi Real Estate Investment Risks (2025): What Every Investor Must Know

Nairobi Real Estate Investment Risks (2025): What Every Investor Must Know

Vietnam Real Estate Investment 2025: Critical Risks, New Regulations & Insider Tips for Foreign Investors

Vietnam Real Estate Investment 2025: Critical Risks, New Regulations & Insider Tips for Foreign Investors