How Rapid Change and AI Are Reshaping Global Investing

We’re living in a time of breathtaking transformation. Just a few years ago, Generative AI didn’t exist. Now it’s rewriting the rules of how we live, work, and think.

What once took me days or weeks of research: YouTube deep dives, endless articles, late-night note-taking. Now takes seconds with one well-crafted prompt.

This speed of change doesn’t just reshape information; it reshapes how we invest, build wealth, and prepare for the future.

AI is accelerating innovation faster than ever before, and that means investors who stay static risk being left behind.

As technology evolves at lightning speed, one timeless truth remains: diversification is the most reliable form of protection.

My Investment Philosophy: Diversify or Risk Falling Behind

If you’ve followed my blog for a while, you know I’m a strong believer in diversification across both asset classes and geographies.

I’ve personally invested in:

- Real estate (Asia, Africa, and the Middle East)

- Stocks (primarily global index funds)

- Cryptocurrencies (Bitcoin and Ethereum)

- Gold is the only asset I haven’t seriously touched yet

I diversify not just across assets, but also within them. My crypto is spread across multiple exchanges and wallets. My real estate holdings are in several countries. My stock exposure comes through global ETFs.

Because the past few years have taught us that anything can happen.

If there’s one lesson from recent history, it’s this: stability is an illusion, and adaptability is survival.

Why I’m Shifting Focus Beyond Europe

After years of investing within Europe, I’ve gradually reduced my exposure there.

Here’s why:

❌ Economic stagnation. The EU has struggled to grow meaningfully, with bureaucracy and politics slowing innovation.

❌ High taxation. The more you earn or own, the more you’re penalized. I’m not against paying taxes, but in much of Europe, success feels punished instead of rewarded.

❌ Limited upside. Europe will always remain a cultural gem and tourism hotspot, but in terms of growth, it’s unlikely to be the center of innovation in the coming decade.

So, I’m shifting my focus from mature economies to markets where the energy still buzzes.

The Power of Emerging Markets in the Next Decade

Emerging markets are no longer the future. They’re the present opportunity that most developed-world investors still overlook. According to the IMF, emerging markets are projected to drive nearly 70% of global GDP growth by 2030.

Here’s where I’ve been investing or actively exploring:

Countries I’ve already invested in: Georgia, Kenya, Cambodia, Oman (almost), and Vietnam

Countries currently on my radar:

Ethiopia, Rwanda, Tanzania, Kazakhstan, Brazil, Mexico, Argentina, and Colombia.

Why these markets?

Demographics. Populations are young, ambitious, and rapidly urbanizing.

Untapped potential. Real estate, infrastructure, and tourism are still in early stages, meaning better entry prices and higher upside.

Global shifts. As supply chains diversify away from China, capital and talent are flowing into new regions.

For me, it’s not about chasing the next hot market. It’s about identifying real value and real demand.

My Real Estate and Portfolio Strategy Across Continents

As global population growth slows, housing demand will eventually soften. That means being more selective with location and asset type is essential.

My investing guidelines:

Focus on Tier-1 and Tier-2 cities in emerging countries where the population is still young and jobs are abundant.

Prioritize nature and community. Everywhere I go, people crave greenery, peace, and human connection. As life becomes more digital, our desire for real spaces grows stronger.

These kinds of properties tend to perform well both short term for rentals and long term for appreciation.

The Case for Bitcoin and Gold

Owning real estate brings stability, but it also ties you down. If political unrest or war breaks out, you can’t move your property or access your funds quickly.

That’s why I keep a portion of my wealth in Bitcoin and gold — assets that can cross borders with me.

They act as freedom assets: mobile, liquid, and globally recognized. In a world of uncertainty, portability equals security.

My Stock Market Strategy

After experimenting with different strategies, I realized that simplicity often wins. Today, most of my stock portfolio sits in the Vanguard All-World Index Fund (VWRA), a single, globally diversified ETF that holds shares of the world’s top-performing companies.

I like it because it mirrors my life philosophy: spread across regions, balanced in exposure, and focused on long-term growth.

No guessing. No daily stress. No emotional trading. Just quiet compounding.

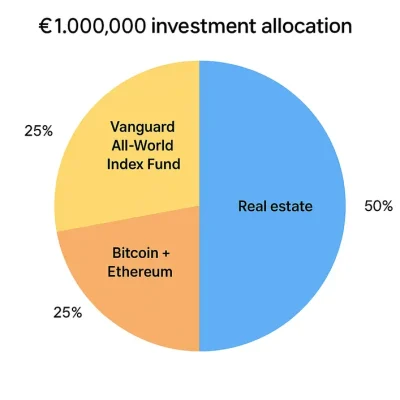

If I Had One Extra Million Euros to Invest

Here’s how I’d divide it:

| Allocation | Investment | Purpose |

|---|---|---|

| €500,000 | Buy a spacious property in Brazil (Rio de Janeiro or Fortaleza) or Colombia (Medellín), and split it into 3-5 beautiful, fully furnished rental apartments | Steady rental income + lifestyle flexibility |

| €250,000 | Vanguard All-World Index Fund | Long-term global growth + compounding returns |

| €250,000 | Bitcoin + Ethereum | Liquidity + borderless wealth mobility |

You should see this as inspiration, not a blueprint.

My portfolio reflects my own risk appetite, cash flow, lifestyle, and financial goals, which are likely very different from yours.

Every investor’s path is personal. What works for me might not suit your timeline, comfort level, or life situation.

The key is to understand your why and build a portfolio that supports it.

Building Freedom Through Residency and Mobility

Diversifying assets is one form of freedom. Diversifying residency is another.

This is one area where I’ve learned a hard lesson.

I was eligible to apply for a Georgian residence permit through investment, but I delayed it, thinking it wasn’t urgent. Now I realize how crucial it is to secure mobility options early.

At the moment, I hold only a Dutch passport and a three-year Vietnam visa exemption. That’s it.

Having an additional residency or passport isn’t about escaping taxes. It’s about building flexibility and peace of mind. In unpredictable times, freedom of movement is a priceless asset.

How My Partner and I Approach Relocation

Relocation is a big part of both our life and our investment journey. We’ve dreamed of moving somewhere with lower taxes and greater freedom, but finding a place that feels right on every level is far harder than it looks.

❌ We tried Italy, but the reality didn’t match the dream.

❌ We considered Vietnam, but the air and noise pollution made daily life stressful.

❌ Now we’re in Norway, surrounded by nature, peaceful, safe, and stunning, yet undeniably expensive and limited in lifestyle variety.

The truth is, no place is perfect. Every country gives something and takes something away.

For us, that journey is still unfolding. We’ll keep exploring until we find our imperfect, perfect match, a place that feels right in all the ways that matter most.

Final Thoughts: Adapting to a Fast-Changing World

The world is evolving faster than ever — politically, economically, and technologically. AI is reshaping industries, markets are shifting overnight, and what once felt safe no longer guarantees stability.

But change isn’t something to fear. It’s something to understand, adapt to, and grow through.

For me, investing has never been just about returns. It’s about freedom, resilience, and alignment.

🔥 The freedom to choose where I live, what I build, and how I spend my time.

🔥 The resilience to stay calm when the world shakes.

🔥 And the alignment between my money, my values, and the life I want to create.

That’s why I diversify — not out of fear, but out of awareness.

Because the next decade won’t reward those who try to predict every outcome.

It will reward those who stay curious, flexible, and prepared for anything.

So wherever you are on your journey, whether you’re just beginning to invest or already building across borders, remember this:

✅ You don’t need to time the world.

✅ You just need to be ready for it.

Happy Investing! 🚀

Related posts:

From Vietnam to Kenya: Why I’m Investing More in Emerging Markets

From Vietnam to Kenya: Why I’m Investing More in Emerging Markets

Offshore Companies & Tax Evasion (6 Chapters)

Offshore Companies & Tax Evasion (6 Chapters)

Part 6 (Final): Words of Caution

Part 6 (Final): Words of Caution

How to Start Investing in Crypto with Just $1: A Beginner’s Guide

How to Start Investing in Crypto with Just $1: A Beginner’s Guide

Two Weeks in Kenya: What I Learned, What I Invested In, and Why I’m Going Back

Two Weeks in Kenya: What I Learned, What I Invested In, and Why I’m Going Back

The Stereotypes I Had About Kenya—And How Completely Wrong I Was

The Stereotypes I Had About Kenya—And How Completely Wrong I Was