Vietnam’s real estate market has quickly become one of Southeast Asia’s top investment destinations, attracting both local and foreign investors. Among its bustling cities, Ho Chi Minh City stands out as the most promising hotspot for foreign buyers in 2025. So, what makes Vietnam—and specifically Ho Chi Minh City—such an attractive choice for investors?

In this article, I’ll take you through the eyes of both a local and a European investor, shedding light on the unique dynamics and opportunities that make this market stand out.

Top Reasons to Invest in Vietnam Real Estate

If you’ve followed my blog, you know I’m passionate about real estate investments. Vietnam has always intrigued me, but for a long time, I hesitated due to the complexities of its market.

Before diving into Vietnam’s real estate market, I was on a quest for a hidden gem—a country offering:

- High rental yields (at least 10%) with capital appreciation of at least 10% per year

- Or double or triple capital investment in the coming 5 years

- Political stability and safety, far from conflict zones that could impact investments

I analyzed a wide range of countries, from well-known European destinations like the Netherlands, Norway, Spain, and Portugal to less-talked-about locations like Armenia, Romania, and Macedonia. I even explored opportunities outside of Europe in Central Asia, South America, and Africa.

While my goal might sound ambitious, it’s not wishful thinking—I already own properties that have delivered exceptional returns. For example, one property tripled in value over eight years, and another yields nearly 20% annually in rental income, with 50% appreciation over just three years.

Countries like Kazakhstan, Vietnam, and Colombia caught my attention. Initially, I was drawn to Colombia and even planned to spend two months in Medellín to scout properties. But then, I had an epiphany: While Colombia offers great potential, it’s unfamiliar to me. I don’t speak Spanish, I’ve never visited, and safety concerns linger based on my experiences traveling in South America.

That’s when I realized: Why not invest in Vietnam—my motherland—where I hold a natural advantage? While I’m not Vietnamese by nationality and must follow the same rules as any foreigner, I speak the language, understand the culture, and can navigate local nuances. This gives me a strategic edge to make more informed decisions.

Vietnam’s Unique Advantages for Real Estate Investors

1. Booming Economy & Robust GDP Growth

Vietnam’s rapid economic growth has earned it titles like “The Asian Growth Leader” and “Tiger Cub Economy.” It’s consistently one of Southeast Asia’s fastest-growing economies, thanks to industrialization, a booming manufacturing sector, and increasing foreign investment.

Key statistics highlighting this growth:

- GDP Growth Rate: Vietnam achieved an impressive 8.02% GDP growth rate in 2022, making it one of the highest in the region.

- Foreign Direct Investment (FDI): In 2022, the country attracted $27.72 billion in FDI, particularly in manufacturing and electronics, driven by global giants like Samsung, LG, and Intel.

- Manufacturing Hub: The manufacturing sector grew by 9.8% in 2022, offsetting global slowdowns from the pandemic.

- Exports: Vietnam’s exports consistently grow over 10% annually, reaching $371.5 billion in 2022.

This economic growth has triggered rapid urbanization in cities like Ho Chi Minh City and Hanoi, increasing demand for residential, office, and commercial spaces, driving property values higher.

2. Major Exporters and Global Rankings

Vietnam has proven itself a powerhouse in global trade across various sectors. Here are some impressive statistics:

- Electronics (Mobile Phones): 2nd-largest mobile phone exporter globally (after China), valued at $57.54 billion in 2022.

- Textiles and Garments: 3rd-largest textile exporter (after China and Bangladesh), earning $37.57 billion in 2022.

- Footwear: 2nd-largest footwear exporter (after China), generating $23.9 billion in 2022.

- Agriculture:

- 3rd-largest rice exporter (after India and Thailand), earning $3.49 billion.

- 2nd-largest coffee exporter (after Brazil), reaching around $4 billion.

- Top 5 global seafood exporter, totaling $11 billion in 2022.

- Largest black pepper exporter, valued at $1 billion.

These industries reflect Vietnam’s strength in global trade, making it a resilient and attractive location for investors in sectors beyond just real estate.

***Just me thinking, in times of global crises—such as geopolitical conflicts or another pandemic—Vietnam’s robust agricultural sector provides such a great buffer for economic resilience. At the end of the day, we can survive without technology, oil, or gas, but we cannot live without food. Investing in Vietnam isn’t just about financial returns—it’s also a hedge against future uncertainties grounded in essential resources.

3. Growing Population: Sustained Demand for Housing

Vietnam’s population is estimated at around 100 million in 2023, making it one of the most populous countries in Southeast Asia. Unlike many countries facing population decline, Vietnam is experiencing steady growth, with a fertility rate of around 2.0 births per woman (World Bank, 2023; United Nations Population Division, 2023).

Even more important for investors, around 64% of the population is within the working-age bracket, fueling economic growth and sustaining high demand for housing, particularly in urban areas like Ho Chi Minh City.

From my personal experience traveling to nearly 50 countries, I’ve never encountered as many pregnant women and young families as I have in Vietnam. Everywhere you go—cafés, restaurants, even nightlife spots—families are ever-present, reflecting the country’s emphasis on family and community values.

This strong demographic growth ensures that housing demand will continue to rise, presenting excellent long-term investment opportunities in residential real estate.

Why Invest in Ho Chi Minh City’s Real Estate Market?

Choosing the right location to invest in Vietnam was no easy task for me. Spanning over 331,000 square kilometers (128,565 square miles), Vietnam is a vast and diverse country. To put that in perspective, it’s about the size of Germany, larger than Italy and the UK, and nearly three times the size of South Korea. This vastness hints at the abundant investment opportunities.

To narrow my focus, I evaluated major cities: Hanoi, Ho Chi Minh City (HCMC), Hai Phong, and popular beach destinations like Da Nang, Nha Trang, and Quy Nhon. While the coastal cities have their appeal, I prioritized major economic centers and capital cities, which led me to eliminate the beach towns.

Why Not Hanoi?

Despite being the capital, Hanoi has become prohibitively expensive, with real estate prices surpassing those in HCMC. The city struggles with severe traffic congestion and air pollution. While maximizing financial returns is my primary goal, I also want to invest in a place I can enjoy visiting regularly—something I couldn’t see myself doing in Hanoi.

This left me with two strong contenders: Hai Phong and Ho Chi Minh City. Although Hai Phong is Vietnam’s second-largest industrial hub and home to my family, its population of just over 2 million pales in comparison to HCMC’s 10 million residents. Additionally, Ho Chi Minh City accounts for nearly 23% of the country’s GDP, solidifying its status as an economic powerhouse. After thorough research, I was convinced that Ho Chi Minh City offered greater long-term capital appreciation potential, so I decided to focus my investments in this dynamic and vibrant city.

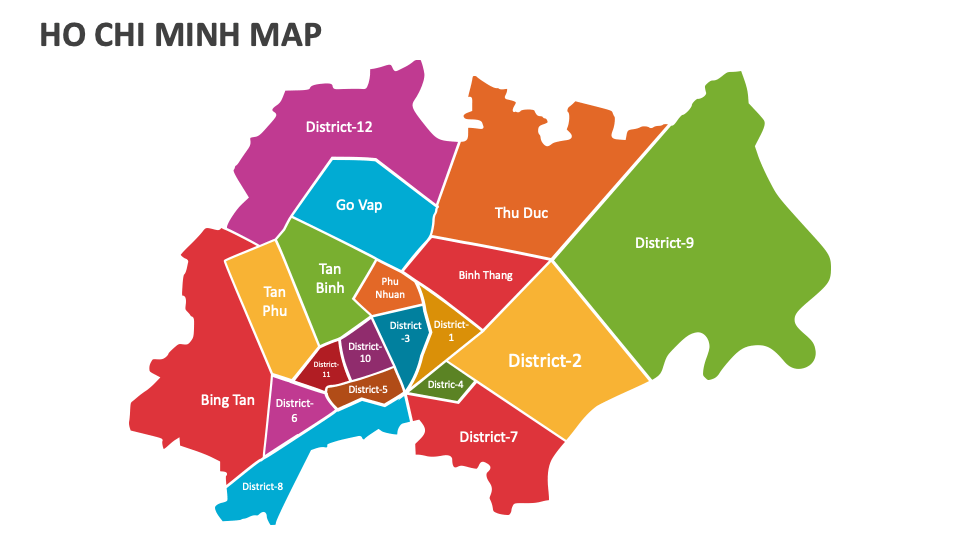

Key Districts: Distinctive Characteristics and Investment Opportunities

Ho Chi Minh City is a sprawling metropolis comprising 16 urban districts, 5 suburban districts, and 1 city within its boundaries, Thủ Đức City. To give you a sense of scale, the distance from District 1, the city center, to Củ Chi District, a suburban area in the northwest, spans 30 to 35 kilometers (about 19 to 22 miles). For perspective, Ho Chi Minh City is 1.31 times larger than London, 2.63 times larger than New York, and 9.41 times larger than Amsterdam.

Each district presents unique opportunities for property investment, catering to various preferences and budgets. Here’s a breakdown of the most promising districts:

District 1 – The Central Business District (CBD)

- Character: The heart of HCMC, known for its towering skyscrapers, luxury hotels, and embassies.

- Real Estate: Highly competitive and expensive, making it ideal for luxury commercial and residential investments.

District 2 (Thu Thiem) – The New CBD

- Character: Once a rural area, now emerging as an upscale urban hub.

- Real Estate: Rapidly growing, with high-end developments and luxury condos, although prices are already steep.

District 7 (Phu My Hung) – Expat Haven

- Character: A friendly environment for expats, featuring modern infrastructure and green spaces.

- Real Estate: Popular among expats, offering luxury condos with strong rental demand.

District 4 – Up-and-Coming Area

- Character: Historically less developed, now undergoing significant gentrification.

- Real Estate: More affordable yet presents strong growth potential due to its proximity to District 1.

Binh Thanh District – Central & Growing

- Character: A blend of local developments and high-end projects, including Landmark 81.

- Real Estate: High-end condos are gaining popularity due to proximity to the Saigon River and District 1.

Thu Duc City – The Future Tech Hub

- Character: Formed by merging Districts 2, 9, and Thu Duc into a “city within a city.”

- Real Estate: Promising long-term growth, with numerous large-scale urban development projects underway.

1. Rapid Urbanization in Ho Chi Minh City

Ho Chi Minh City is experiencing a wave of rapid urbanization, with more individuals flocking to its bustling streets in search of economic opportunities. Currently, about 38% of Vietnam’s population resides in urban areas, a figure projected to soar to 50% by 2045 (General Statistics Office of Vietnam, 2023). In Ho Chi Minh City, this influx is driving increased demand for housing, infrastructure, education, and healthcare (Vietnam Investment Review, 2023).

As the government actively promotes urban development through policies supporting affordable housing and infrastructure improvements, the trend of migration to major cities is expected to accelerate. Individuals are increasingly seeking better educational and job prospects, making Ho Chi Minh City an attractive destination for those looking to improve their quality of life (The Investor, 2022).

With this rapid urbanization, the real estate market is poised for significant growth, offering lucrative investment opportunities for both local and foreign investors eager to capitalize on the evolving landscape of Vietnam’s largest city.

2. Abundance of Property Investment Options

Ho Chi Minh City boasts a vibrant real estate market, offering a diverse array of property investment options. From budget-friendly apartments located in the city’s outskirts to ultra-luxurious villas nestled in prime locations, there truly is something for everyone, catering to various budgets and lifestyle preferences.

The city’s rapid urbanization is further fueled by significant infrastructure projects like the new Metro Line, which enhances connectivity across districts. This improved accessibility not only makes urban living more attractive but also significantly boosts the potential for property appreciation. Investors can capitalize on emerging neighborhoods that are becoming increasingly desirable as transportation options expand.

As Ho Chi Minh City continues to grow and evolve, the opportunities in its real estate market are vast. Whether you’re looking for a cozy starter home, a rental property, or a high-end investment, the city’s dynamic landscape provides ample choices for savvy investors eager to explore its rich potential.

3. Significant Appreciation Potential

I see Ho Chi Minh City as a younger version of Shanghai. Although I haven’t yet visited Shanghai, media coverage of China’s rapid development has shaped my perspective. Since the late 1980s, Vietnam has made significant strides in transitioning its economy and political system toward greater openness and accessibility. Major social platforms—such as TikTok, Facebook, Instagram, and X—are readily available without the need for VPNs, and international payment methods are widely accepted

While Vietnam is progressing quickly, it still lags about five years behind China, creating unique opportunities for investors. Real estate prices in Ho Chi Minh City remain relatively affordable compared to those in Shanghai, yet the upward trend is unmistakable.

I believe that within the next five years, today’s affordable properties could reach price levels akin to those in Shanghai. The limited availability of land in prime areas, coupled with a steady influx of migrants seeking better opportunities, indicates a strong upward trajectory in property values. For instance, as Shanghai experienced rapid urbanization and economic growth, its property market surged, and Ho Chi Minh City is poised for a similar trajectory.

Though we may encounter short-term fluctuations—potentially reminiscent of crises like the 2008 downturn—the long-term outlook remains promising. As infrastructure develops, including the upcoming metro system, and urban migration continues to rise, property values in Ho Chi Minh City are likely to experience significant appreciation.

4. High Rental Yields on the Horizon

The rental market in Ho Chi Minh is currently favoring tenants, thanks to relatively low rental prices compared to property purchases. For approximately 18 million to 25 million VND (~$650-$950), you can rent a decent two-bedroom apartment complete with amenities such as a swimming pool, gym, and cleaning services in prime locations throughout Ho Chi Minh City.

Cities like Ho Chi Minh City and Hanoi have experienced rising rental yields, with some neighborhoods seeing increases of up to 10% year-on-year in rental prices. Notably, areas like District 1, Thao Dien in District 2, and Phu My Hung in District 7 are particularly popular among expats and digital nomads, driving further demand. According to a report by CBRE, Vietnam’s rental market is exhibiting robust growth, spurred by increasing demand from both local and foreign tenants.

In 2023, Vietnam welcomed approximately 12.6 million international visitors, marking a significant recovery in the tourism sector, with ambitions to attract 17-18 million international visitors in 2024. This influx of tourists has notably boosted demand for short-term rentals, especially in urban centers like Ho Chi Minh City. Moreover, the expat population is rising, with around 1.5 million foreigners currently residing in Vietnam, many drawn to its vibrant culture, lower living costs, and burgeoning tech scene.

Given the growth rate, birth rate, influx of foreign direct investment, and surge in digital nomads, the rental market is poised for substantial expansion. Recent trends indicate that Vietnam is becoming a favored destination for digital nomads, with initiatives like the Vietnam Digital Nomad project promoting the country as a hub for remote work.

My personal verdict is that rental prices will gradually align more closely with actual property prices. Such alignment suggests promising appreciation and higher rental income in the near future for investors like us.

5. A Fun, Affordable, and Safe City

Investing in Ho Chi Minh City not only promises financial returns but also offers a vibrant and enriching lifestyle. Imagine owning a property in a city brimming with attractions, from bustling local markets to remarkable historical sites like the War Remnants Museum and Cu Chi Tunnels. Even if your investment property is primarily for rental, having a place to visit occasionally is a significant perk.

With a cost of living significantly lower than in many Western cities, Ho Chi Minh City emerges as an ideal choice for savvy investors. For instance, a meal at a mid-range restaurant costs about 200,000 VND (approximately $8.50), making dining out not just delicious but also affordable. You can even enjoy three satisfying meals a day for less than $10 if you opt for small local eateries.

Quality Healthcare at Affordable Prices

The city’s private healthcare system further enhances its appeal, known for being both high-quality and cost-effective. For just $100, I underwent a comprehensive health checkup, including various tests, with results ready within an hour. Overall, medical expenses in Vietnam are significantly lower than those in Western countries, making healthcare both accessible and reliable.

A Lifestyle Choice

If I were to return to live in Vietnam, Ho Chi Minh City would undoubtedly be my top choice, with occasional escapes to beautiful beach towns. Many of my well-traveled friends who have lived abroad have returned to Vietnam, sharing how they find everything they need here at a fraction of the cost.

Safety and Adventure

Most importantly, Vietnam is a safe country, rich in diverse landscapes and cultural experiences. From stunning beaches to breathtaking mountains, there’s much to explore, with some places rivaling destinations in Europe. For example, Ha Giang’s dramatic mountain scenery competes with Switzerland, while Quy Nhon boasts coastlines reminiscent of Greece.

According to the Global Peace Index, Vietnam ranks favorably for safety, with petty crime being the most common concern, such as pickpocketing or being overcharged. Serious threats to personal safety are rare, making it an appealing destination for tourists and expats alike. The U.S. Department of State notes that Vietnam has a relatively low crime rate, and local authorities are generally responsive to public safety concerns.

In summary, Ho Chi Minh City presents an exciting blend of affordability, safety, and vibrant culture—making it an attractive destination for both investors and those seeking a rich lifestyle. Whether you’re drawn by the financial opportunities or the vibrant lifestyle, this city has something to offer everyone.

Challenges and Risks Facing Foreign Investors in Vietnam

Let’s be frank: the Vietnamese real estate market is not a walk in the park. Despite my familiarity with the language and culture, I find it to be one of the most complex markets I’ve encountered.

1. Lack of Centralized, Objective, and Transparent Information

In countries like the Netherlands, Norway, and Dubai, investors have easy access to a wealth of information. Unfortunately, this is not the case in Vietnam, where the lack of transparency can be daunting for both local and foreign investors.

According to a Colliers International report, many investors struggle to find reliable, objective data to guide their decisions. Transparency International ranks Vietnam 117th out of 180 countries for perceived corruption, highlighting the importance of thorough due diligence.

During my six-month research journey from abroad, I often felt lost and frustrated. The fragmented information landscape, along with the prevalence of scams and bureaucratic obstacles, made investing incredibly challenging.

2. Scams and Frauds at Every Stage

This is one of the biggest reasons that have kept me away from investing in Vietnamese real estate. Scams can occur at every stage of the process and can involve anyone—sales brokers, agencies, sellers, and even acquaintances. I nearly fell victim to a land scam involving the mother of a close friend during the COVID-19 pandemic. Fortunately, I had the presence of mind to seek advice from my brother, who is local, just minutes before the transfer. It turned out to be a typical land scam.

Have you ever been in a country where warnings about scams pop up in the news all the time? That’s Vietnam for you! Yet, despite all those warnings, real estate scams are still as common as ever.

Ken Duong, a business lawyer, entrepreneur, and investor in Vietnam for 15 years, assists businesses and expats in seamlessly navigating investments in the country. In a recent video, he stated that “lying is the national pastime of Vietnam.” Initially, I thought that was such a harsh statement, but as he explained his viewpoints, I couldn’t help but nod in agreement. He emphasized that affluent and powerful individuals in Vietnam often deceive their way to accumulate more wealth and power.

A significant example is Truong My Lan, chairwoman of the Van Thinh Phat Group, accused of orchestrating one of Vietnam’s largest financial frauds, leading to losses of 304 trillion VND (about $12.5 billion), nearly 3% of Vietnam’s GDP for 20222 (Global News)(Voice of America)

Similarly, former President Nguyen Xuan Phuc was implicated in selling overpriced COVID-19 test kits, leading to estimated losses exceeding 4 trillion VND (approximately $172 million). These incidents raise questions about the integrity of Vietnam’s investment environment.

Interestingly, when I invested in Georgia and Cambodia, I felt confident. Yet now, I find myself overwhelmed with doubt about investments in Vietnam.

Common Scams and Frauds in Vietnamese Real Estate

Navigating the real estate landscape in Vietnam can be challenging, not only for locals but even more so for foreign investors who are unfamiliar with local practices and regulations. Below are some common scams and fraudulent practices that potential buyers and investors should be aware of:

Scams:

- Fake Land Use Rights: Scammers may sell properties using counterfeit land rights and certificates, misrepresenting their ownership or the legal status of the land.

- Phantom Properties: Some developers promote properties that do not exist or are not yet built, enticing buyers with attractive prices and promised returns—only for them to discover it’s a scam.

- Overpricing and Hidden Fees: Investors may encounter properties listed at inflated prices, along with undisclosed fees for maintenance, management, or transactions, leading to significant financial losses.

- Investment in Unlicensed Projects: Some projects are marketed without the proper licenses or approvals. Investing in such developments can result in legal troubles and loss of investment.

- Misleading Contracts: Scammers may provide contracts that include misleading clauses or terms unfavorable to the investor. It’s crucial to have contracts reviewed by legal professionals.

Frauds:

While not categorized as scams, these misleading practices are prevalent:

- Substandard Construction: Developers may use inferior materials to cut costs, leading to properties that do not meet expected quality standards, resulting in structural issues and increased maintenance costs.

- Unfinished Projects: Many developments are marketed with attractive features, but investors often find that projects are delayed or lack promised amenities like swimming pools and gyms. According to a 2022 report by the Vietnam National Real Estate Association, around 30% of real estate projects face delays, which adds to investor frustration.

- Misrepresentation in Marketing: Some developers present misleading information in marketing materials, showcasing luxurious designs and features that are not delivered upon completion.

- Legal Challenges: Properties built with low-quality materials may face legal challenges from local authorities, especially if construction violates regulations, causing further complications for investors.

- Poor Property Management: After completion, many projects suffer from poor property management, leading to deteriorating conditions soon after handover. Buildings with issues such as elevator malfunctions, water leaks, and lack of regular maintenance have been reported, affecting the long-term value of the property and the living experience for residents.

The Risks of Buying from Retail Sellers

Buying finished properties from retail sellers in Vietnam comes with its fair share of risks, and the scams can be just as shocking as those seen in new developments. For instance, sellers might present a “pink book”—the official certificate of ownership—only for the buyer to later find out that the property has already been sold to multiple people. This kind of double-dealing happens more often than you’d think and can leave buyers stuck in messy legal battles.

Another common pitfall is when sellers promise to leave behind furniture and appliances as part of the deal, but then mysteriously remove valuable items before handing over the keys. You might show up on moving day only to find that expensive fixtures, electronics, or even doors have vanished, leaving your new place in shambles. Stories like these are far too frequent in Vietnam’s real estate market, where scams often come with unexpected twists.

To avoid falling into these traps, it’s crucial to do your homework and seek out trusted professionals who can help protect your investment. Being prepared for these potential pitfalls can save you a lot of headaches down the road.

3. Ownership Restrictions in Vietnam

While Vietnam has made significant strides in opening its real estate market to foreign investors, there are still notable limitations:

- Foreign Ownership Limits: Foreigners can purchase property in Vietnam, but only up to 30% of the units in a residential condominium building or 10% of the properties in a landed development.

- Leasehold Land: Foreigners are not permitted to own freehold land. Instead, they can lease land for up to 50 years, with the potential to renew the lease under specific circumstances. This restriction often deters long-term investors who prefer the security of land ownership.

These regulations make Vietnam’s ownership rules stricter than those of neighboring countries like the Philippines, Indonesia, Malaysia, and Thailand, which offer more lenient policies and longer leasehold terms (some extending up to 99 years) or even allow some form of freehold ownership for foreigners. For example, in Thailand, while foreigners can’t own land outright, they can own condominiums with fewer restrictions.

These limitations are crucial for foreign investors to understand when considering Vietnam as a real estate investment destination. Therefore, careful legal guidance and a thorough understanding of these regulations are essential to ensure a smooth and compliant investment process.

4. Complex Legal Framework in Vietnam’s Real Estate Market

I’ve said it before, and I’ll say it again—Vietnam’s real estate market is one of the most complex I’ve encountered in my investment journey. Even as a native Vietnamese speaker, fully fluent in the language, navigating the legalities feels impossible without the help of trusted legal professionals or agents.

Before arriving in Vietnam, I spent six months researching, convinced I could handle the market’s nuances. I thought that my preparation, along with two weeks of intensive property visits in Ho Chi Minh City, would be enough to uncover great opportunities. But I quickly learned that paperwork can be a whole different beast.

Adding to the complexity are recent regulatory changes. As of August 1, 2024, thousands of property transactions have been delayed at the Ho Chi Minh tax department due to a new tax law, which created widespread confusion. Buyers, regardless of nationality, must now prove their marital status. In my case, I had to provide an official document from the Dutch government—something I’ve never had to do when purchasing property elsewhere.

And if you’re married, your spouse must sign off on any property transaction, whether you’re buying or selling. This is just one of the many intricate legal hurdles unique to Vietnam’s real estate market.

While Vietnam’s real estate market offers fantastic opportunities, they come with significant challenges. The ever-evolving legal framework, coupled with a sometimes lengthy process, highlights the importance of working with an experienced local lawyer or trusted real estate agent. Without their help, you could easily find yourself entangled in a web of unforeseen complications.

5. Market Saturation in Certain Areas

Popular districts like District 1 and District 2 in Ho Chi Minh City have seen a property development boom over the past decade, fueled by both domestic and foreign investment. These areas have become some of the most desirable spots in the city, attracting a lot of attention. However, with all this new development comes the risk of oversupply.

The surge in high-end apartments and office spaces can lead to market saturation, making it more challenging to achieve competitive rental yields or see significant capital appreciation in the short term. When too many properties flood the market, it can create fierce competition among landlords and investors, driving down rental prices and diminishing returns.

6. Competition in Vietnam’s Real Estate Market

Just like in China, real estate is a preferred strategy for Vietnamese citizens looking to preserve and grow their wealth while hedging against inflation. National statistics show that around 90% of households in Vietnam already own their homes. This deep-rooted cultural affinity for property investment makes the market incredibly competitive.

With a population of about 100 million, Vietnam has a growing middle class constituting 35-40% of the population. The upper class—around 5-10%—is increasingly active in real estate investments. Insights from organizations like the Boston Consulting Group (BCG) and McKinsey & Company indicate that many upper-class individuals own multiple properties and are constantly expanding their portfolios. At least half of the middle-income group either owns a home or is on the hunt for investment properties.

Implications for New Investors:

- Increased Competition: Local buyers and affluent foreign investors from regions like Singapore, Japan, and South Korea are driving up property prices and making desirable investments harder to secure.

- Scarcity of Opportunities: Prime properties in sought-after areas like District 1 and District 2 may become scarce, leading to bidding wars and the need for quick decisions.

- Strategic Insight Required: New investors should:

- Target emerging districts with growth potential.

- Stay informed about government policies on foreign ownership.

- Build a network of local contacts for insights on off-market opportunities.

7. Currency Risk and Banking Restrictions

Banking and Legal Restrictions

One of the most significant concerns often overlooked is the banking and legal restrictions foreign investors face in Vietnam. Many investors don’t realize these issues until they attempt to withdraw their investments or profits from the country. The Vietnamese government has established strict regulations regarding foreign currency transactions and capital movement.

Investors must provide comprehensive documentation for any funds transferred abroad, including contracts, invoices, proof of ownership, and tax declarations. All documents must be translated into Vietnamese and bear official legalization—requirements becoming less common in Europe.

These stringent banking and legal requirements can complicate the investment process, making it essential for foreign investors to be well-informed and prepared to navigate Vietnam’s financial landscape.

Currency Risk

Real estate transactions are typically conducted in Vietnamese Dong (VND), exposing foreign investors to currency fluctuations. While the VND is relatively stable, volatility can occur due to global economic events or local policy changes, impacting profit margins when converting back to a home currency.

Exchange Rate Fluctuations:

The gap between the official exchange rate set by the State Bank of Vietnam (SBV) and unofficial rates can reach 5-10%. Many investors turn to the black market for more favorable rates, but navigating this can be risky. especially for those unfamiliar with the country and its people. The SBV enforces strict currency control measures, requiring banks to verify the legitimacy of foreign currency transactions, which can lead to delays in fund transfers.

While I have successfully exchanged currency at gold shops in Vietnam (for small amounts like a few hundred or thousands of euros), this approach carries risks, such as theft or loss. Carrying large amounts of cash in unfamiliar territories can be uncomfortable.

Banking Limitations

Navigating the banking landscape in Vietnam can be challenging for foreign investors. Not all banks provide the same level of service, and some may have stricter policies or lack experience with international transactions, hindering efficient fund transfers. A 2023 report revealed that many Vietnamese banks still face challenges in streamlining processes for foreign clients, leading to delays and bureaucratic hurdles.

In terms of banking services for foreign investors, I have observed that many foreigners struggle to communicate with bankers due to language barriers. This experience contrasts sharply with my time in Phnom Penh, Cambodia, where I found that every person I encountered at various banks—whether in the city center or the outskirts—spoke fluent English, facilitating much smoother transactions

While my interactions with the Vietnamese banking system are limited—having no business or financial dealings here—I’ve gathered some practical tips to help you navigate this landscape more effectively:

Choose the Right Bank: Research larger institutions like Vietcombank, BIDV, and Techcombank, which often have dedicated services for expatriates. These banks offer better support and streamlined processes. They also provide user-friendly mobile banking options, allowing you to select English as the system language, making transactions significantly easier .

VIP Banking Services: If you transfer over $100K into a local bank, you may be considered a VIP customer, receiving a designated personal banker to assist with your needs. I highly recommend utilizing this service; the VIP treatment can make your banking experience far more enjoyable and efficient.

Prepare Documentation: Ensure your documents are well-organized, legalized, and translated into Vietnamese. This should include proof of income, identification, and relevant contracts. Having everything prepared in advance can expedite the process and reduce stress.

Consider International Banks: Look into international banks with a presence in Vietnam, such as HSBC or Citibank, which often have more experience dealing with foreign clients and can offer a smoother banking experience.

Build Relationships: Establishing rapport with a local bank representative can help overcome language barriers and ensure efficient service. Frequent visits to the same bank can lead to familiar faces, making transactions smoother. Additionally, networking with other foreign investors can lead to recommendations for reliable banking partners.

Check Fees and Charges: Be mindful of any fees associated with international transfers or services. Understanding the fee structure can help you avoid unexpected costs, making budgeting easier.

8. Legal and Compliance Issues

Foreign investors must navigate a complex landscape of regulations to ensure compliance with Vietnamese laws regarding foreign investment and capital repatriation. Adhering to these regulations is crucial, as failure to do so can lead to penalties or complications with future transactions.

It’s essential for investors to stay informed about the latest legal developments and to work with experienced legal professionals who understand the intricacies of the local market. These experts can provide valuable insights into not only compliance requirements but also potential risks and opportunities specific to the investment landscape in Vietnam.

For example, the Investment Law of 2020 and the Law on Foreign Exchange Management outline the necessary steps and documentation required for foreign investments. Engaging with legal experts can help navigate these laws and avoid pitfalls.

Here are real-world examples highlighting the consequences of legal and compliance failures:

1. Slow and Bureaucratic Capital Repatriation

Foreign investors in Vietnam often face delays and complications when trying to repatriate profits. One notable example involved a multinational company operating in the retail sector. Despite adhering to the basic requirements for profit repatriation, they encountered significant delays because of insufficient documentation, particularly regarding tax declarations and proof of ownership. This led to months-long bureaucratic roadblocks, costing the company significant time and resources. In this case, their failure to provide the necessary legal paperwork from the outset exacerbated the delays

Lesson: Foreign investors must ensure they have complete and accurate documentation, particularly for large capital transfers. The government requires all paperwork to be translated into Vietnamese and often legalized, which can slow down transactions.

2. Failure to Comply with Foreign Ownership Limits

In 2020, a real estate investment company attempted to purchase a large stake in a high-demand residential project. However, they failed to account for Vietnam’s foreign ownership laws, which cap foreign ownership at 30% for condominiums. The deal fell through after the foreign investor had already committed substantial resources to the project, resulting in financial loss and legal complications.

Lesson: Foreign investors must pay close attention to Vietnam’s foreign ownership restrictions. In the real estate sector, foreign buyers can only purchase up to 30% of apartments in a condominium building or 10% of the total properties in a landed project.

3. Compliance Failures in the Banking Sector

An Australian business in the import-export industry faced a legal compliance issue when transferring funds from Vietnam to Australia. The company’s failure to provide proof of taxes paid in Vietnam led to a significant delay in the transfer of funds, with local authorities freezing the transaction until all paperwork was in order. The investor’s lack of knowledge regarding the specific requirements for tax compliance delayed their fund repatriation by several months.

Lesson: Ensuring compliance with tax obligations is crucial for foreign investors. In Vietnam, foreign investors must show proof of tax payments before transferring capital or profits abroad, and failure to comply can lead to severe delays or penalties.

4. Real Estate Disputes

Another case involved a foreign investor who purchased land through a nominee arrangement, a common method to circumvent foreign land ownership restrictions. However, due to the legal ambiguity surrounding such arrangements, the foreign investor lost ownership rights after a dispute with the Vietnamese nominee. The courts ruled in favor of the local partner due to Vietnam’s strict property ownership laws for foreigners, resulting in a significant financial loss for the foreign investor.

Lesson: Legal loopholes, such as nominee arrangements, can be risky in Vietnam, as foreign land ownership is heavily restricted. Investors should always consult with legal professionals to ensure compliance with land ownership laws.

These examples underline the importance of thoroughly understanding Vietnam’s legal and regulatory framework before investing. Working with knowledgeable legal counsel, staying updated on regulatory changes, and ensuring compliance with foreign ownership laws and tax obligations can mitigate potential risks.

Who Should Invest in Vietnam?

1. Experienced Investors

For seasoned investors seeking to diversify their portfolios amidst global economic uncertainties—such as potential crises in major economies like the US and EU—Vietnam’s burgeoning real estate market presents a compelling opportunity. With its rapid economic growth and increasing foreign direct investment (FDI), Vietnam stands out as an attractive destination for savvy investors.

2. Culturally Adaptable Investors

Successful investment in Vietnam requires flexibility and a willingness to embrace the local culture and legal systems. Investors with a rigid Western mindset may encounter frustration that hinders their investment outcomes. By understanding and respecting local customs, you can significantly enhance your experience and drive better results in this dynamic market.

3. Financially Prepared Investors

For investors interested in purchasing completed projects in Ho Chi Minh City, a minimum cash reserve of $300,000 is advisable. This amount is essential for effectively navigating the local market and ensures you have a solid range of options to choose from. Securing a mortgage from local banks can be particularly challenging due to stringent regulations and high interest rates, making borrowing an impractical choice for many investors.

4. Long-Term Visionaries

Investing in Vietnam is best suited for individuals committed to a long-term perspective. I firmly believe in the potential of the Vietnamese market for both short- and long-term investments. However, I recommend that only those willing to invest for at least five years consider entering this landscape. The complexities and extensive paperwork involved in property transactions make quick profits unrealistic; the challenges of short-term investing often outweigh potential rewards.

5. Legally Aware Investors

Consulting local legal experts is essential for navigating the intricacies of property ownership laws for foreigners. Ensuring compliance with these regulations not only protects your investments but also provides peace of mind. Engaging with knowledgeable legal counsel can help you avoid costly mistakes and streamline the investment process.

Cambodia vs. Vietnam: A Comparison

Explore my in-depth analysis of the Cambodian real estate market here, covering key investment insights and trends.

Market Opportunities

Vietnam presents a more dynamic market with numerous investment options, offering the potential for higher rewards.

Complexity

Navigating the buying and selling processes, along with the legal documentation and banking services, Vietnam is significantly more complex and challenging compared to Cambodia.

Lifestyle and Experience

For living and leisure, Vietnam undoubtedly takes the lead. The country offers a wealth of activities, diverse landscapes, vibrant food scenes, and a rich culture. During my two weeks in Ho Chi Minh City, I was never short on things to do, whereas I felt a sense of boredom after just a few days in Phnom Penh

My Conclusion: Trust No One in the Vietnamese Real Estate Market

Navigating the complexities of Vietnam’s real estate landscape has taught me one crucial lesson: trust no one. Whether dealing with brokers, agents, or developers, each player has their own agenda, which can sometimes lead to shady deals. While there are trustworthy individuals in the market, they are the exception rather than the rule. It’s essential to verify every detail, consult multiple agents, and approach the market with a critical eye to avoid costly mistakes.

However, despite these challenges, investing in the Ho Chi Minh real estate market can be a rewarding venture. The city boasts a rapidly growing economy, a youthful population, and a burgeoning middle class eager for quality housing and amenities. Ongoing infrastructure development and urbanization efforts promise to enhance property values over time. Furthermore, the high demand for rental properties from both locals and expatriates presents a lucrative opportunity for investors willing to navigate the complexities of the market.

For those seriously considering investment opportunities in Vietnam, I highly recommend checking out Ken Duong’s insightful videos on YouTube. His detailed breakdowns of the country’s investment landscape and insights into local perspectives can save you from making costly mistakes.

A recent study revealed that nearly 50% of foreign investors in Vietnam express concerns about transparency and regulatory compliance, underscoring the importance of working with reputable legal advisors and knowledgeable brokers to guide you through the legal and bureaucratic hurdles.

In conclusion, investing in Ho Chi Minh’s real estate market is not for the faint-hearted, but for those willing to take the plunge and do their homework, the potential rewards are significant. Prepare for a challenging environment and approach every deal with caution and due diligence.

P.S. While I can’t provide hard numbers to illustrate the potential of the Ho Chi Minh real estate market—largely due to the absence of centralized and transparent data—my personal journey over the past two weeks has unveiled exciting insights. Join me as I delve into investment opportunities that promise:

- Aiming for a minimum 10% rental yield and capital appreciation of at least 10% per year.

- The potential for two to three times my capital investment within just 5 years.

Stay tuned for updates on my adventure, and if you’re curious about navigating the Vietnamese real estate landscape, don’t be shy to drop me a message. Let’s explore the opportunities together!

Related posts:

Real Estate Insights: My 2-Week Investment Journey in Ho Chi Minh City (Sept 2024)

Real Estate Insights: My 2-Week Investment Journey in Ho Chi Minh City (Sept 2024)

Vietnam Real Estate Investment 2025: Critical Risks, New Regulations & Insider Tips for Foreign Investors

Vietnam Real Estate Investment 2025: Critical Risks, New Regulations & Insider Tips for Foreign Investors

How to Invest in Cambodian Real Estate as a Foreigner: My Personal Experience as a European Investor

How to Invest in Cambodian Real Estate as a Foreigner: My Personal Experience as a European Investor

Nairobi Real Estate Investment 2025: How I Bought 2 High-ROI Apartments for Under $150K

Nairobi Real Estate Investment 2025: How I Bought 2 High-ROI Apartments for Under $150K

How I Invested in 2 Profitable Businesses in Nairobi For Under $50K | Kenya Investment Guide

How I Invested in 2 Profitable Businesses in Nairobi For Under $50K | Kenya Investment Guide

No Proof, No Problem: Top 5 Countries for Property Investment Without Financial Disclosure in 2025

No Proof, No Problem: Top 5 Countries for Property Investment Without Financial Disclosure in 2025