**NO BULLSHIT**: Think $1 isn’t enough to start investing in crypto? I’m about to prove you wrong. You don’t need thousands of dollars to get started. With just $1, you can start building a Bitcoin portfolio using one of the safest strategies for beginners: Dollar-Cost Averaging (DCA). In this post, I’ll walk you through exactly how to start—no fluff, no jargon—just a simple, effective way to dip your toes into the crypto world.

Prices Keep Climbing, Dollars Keep Shrinking

With inflation soaring and the cost of living skyrocketing, $1 (or €0.94) can barely buy anything in the Netherlands. Yet, I’m here to tell you that with just $1, you can start investing in crypto. It might sound too good to be true, but hear me out.

I never realized I could dollar-cost average (DCA) with as little as $1 per day. If I’d known this earlier, I could have already built a Bitcoin portfolio worth a million dollars or more. Just a few days ago, I was in the same boat as you—unaware that this was even possible.

I’m sharing this because I’ve seen firsthand how powerful and achievable this strategy is. It’s simple, low-risk, and anyone can do it. Why not take the leap and give it a shot?

I don’t profit from your decision to invest. I’m not selling courses or earning commissions from crypto platforms. My only goal is to share something I truly believe in that can benefit anyone. And hopefully, you’ll find my content valuable enough to stick around—it’s your support that keeps me motivated to keep writing.

Disclaimer: I’m not a financial advisor. What I’m sharing is based on my personal experience. Always use your own judgment, and if you’re unsure, consult a financial advisor before making any investment decisions.

What is Dollar-Cost Averaging?

Dollar-Cost Averaging (DCA) is a simple and effective investment strategy where you invest a fixed amount of money at regular intervals—whether the price is high or low. This strategy is especially useful for volatile markets like Bitcoin, where prices can swing dramatically from day to day. Instead of trying to time the market, you buy Bitcoin consistently over time, which helps reduce the risk of buying at the wrong time.

Let me explain with a simple scenario:

Scenario 1: You invest $1 each day for a year. If the price of Bitcoin fluctuates, you’ll buy at both low and high points, averaging your cost. Over time, this strategy helps you take advantage of market dips and avoid the stress of buying when the price is at its peak.

Scenario 2: You invest a lump sum of $365 at once. If the market happens to be high when you make the purchase, you could miss out on cheaper opportunities down the line.

Why Dollar-Cost Averaging Works

1. Lowers Risk: DCA eliminates the risk of investing a lump sum when prices are high. By spreading your investment over time, you reduce the chance of buying at the wrong moment and improve your chances of a smoother entry into the market.

2. Encourages Consistency: Committing to regular, smaller investments ensures steady growth. You don’t need to time the market perfectly—you just need to stick with your schedule, no matter what’s happening in the market.

3. Reduces Stress: DCA takes the pressure off. You don’t have to worry about catching the “perfect moment” to buy. Instead, you automatically invest at set intervals, removing the emotional rollercoaster that comes with trying to time the market.

Start Small, Grow Big

DCA is all about consistency. Whether it’s $1 or $100, regular investments will add up over time. Even if the market seems volatile at first, your steady contributions will compound, leading to significant growth in your portfolio.

How Investing $1, $5, or $10 a Day Can Grow Exponentially

Let me show you some solid numbers to illustrate how small daily investments can snowball into substantial returns.

2024 Scenarios (56% ROI)

Imagine starting a simple daily Bitcoin investment on January 1, 2024, and sticking with it until November 19, 2024 (the date I’m writing this post). Here’s how your investment would grow:

- $1/day: Your total investment of $323 would grow to $180.88 in returns.

- $5/day: With a $1,615 investment, your returns would be $904.40.

- $10/day: Doubling that effort to $3,230 would yield $1,808.80 in returns.

For comparison, if you left the same $323, $1,615, or $3,230 in a typical savings account, you’d likely earn less than $10 in interest by the end of the year. DCA in Bitcoin offers a much better return on your investment.

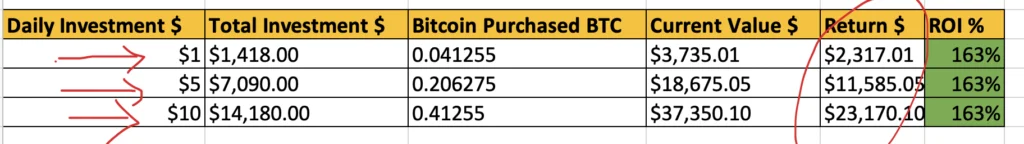

3-Year Scenarios (163% ROI)

Now, imagine starting your daily Bitcoin investment on January 1, 2021, and continuing through one of Bitcoin’s most volatile periods. Despite massive price swings, regulatory challenges, and market corrections, those who stuck with DCA saw their investments grow by 163%.

Here’s the breakdown:

- $1/day: Your total investment of $1,418 would grow to $3,735.01, earning a profit of $2,317.01.

- $5/day: A $7,090 investment would grow to $18,675.05, yielding a profit of $11,585.05.

- $10/day: With $14,180 invested, your balance would reach $37,350.10, resulting in a profit of $23,170.10.

These numbers aren’t fantasy—they’re based on real historical Bitcoin performance. Special thanks to the Bitcoin DCA Calculator, a free, easy-to-use tool, I was able to track the impact of consistent investments.

Have you ever thought that investing just $1, $5, or even $10 a day could snowball into such remarkable returns?

Honestly, I hadn’t—until I crunched the numbers. It’s truly eye-opening. If I had known this earlier, there’s no doubt I’d already have a Bitcoin portfolio worth over a million dollars. This just proves that the power of DCA lies in its simplicity and consistency.

More Proof?

For even more proof, check out these real-life examples:

TikTok video (in Vietnamese): The creator consistently invested $10 a day from January 26, 2022. By November 16, 2024, his total investment of $10,106.00 had grown to $19,030.83, yielding a return of 187.31%.

YouTube Video (in English): Another creator consistently invested $1 a day into Bitcoin for 916 days. By the end, his total investment of $916 grew to $3,920.89, with a profit of $3,004.89 (328.13% return).

These examples illustrate how consistently investing in Bitcoin over time can yield impressive results, no matter your starting point.

Is DCA the Right Strategy for You?

If you’re like my mum, uncle, aunt, older sister, or close cousins—those who may not have much experience with crypto, prefer low-risk investments, and want to avoid the stress of market fluctuations—then Dollar-Cost Averaging (DCA) could be the perfect long-term, hands-off investment for you.

Starting with as little as $1 a day, DCA lets you invest steadily over time without the need for a large, risky upfront commitment. It’s a simple, effective, and low-stress way to grow your wealth—just the way investing should be. With DCA, you can take the guesswork out of investing and focus on long-term growth without worrying about the daily ups and downs of the market.

Why DCA in Bitcoin? Why Not Stocks or Bonds?

When you’re investing small amounts like $1 to $10 a day, traditional investments like stocks or bonds can be tricky. The reason? High transaction fees can quickly eat away at your returns, and not all platforms let you buy fractional shares.

Let’s take Tesla as an example. On November 19, 2024, Tesla shares were priced at $338.74. On DeGiro, a popular platform in the Netherlands, you’d need at least $338.74 to buy just one full share. And when you add up the fees:

- Base fee: €0.50

- Exchange fee: €2.50 (for U.S. stocks)

- Per share fee: €0.004

Here’s how that looks when we convert everything to euros (using an exchange rate of 1 USD = 0.94 EUR):

- Tesla share price in euros: €318.40

- Total fees: €0.50 (Base Fee) + €2.50 (Exchange Fee) + €0.004 (Per Share Fee)

- Total cost: €321.40 (approx.)

To make a small daily investment in Tesla, your fees would quickly add up, cutting into your investment. That’s where Bitcoin stands out. With its lower transaction fees, more of your money goes directly into your investment. Plus, Bitcoin has a much higher growth potential than traditional assets, making it an ideal choice for small-scale investors looking for more significant returns.

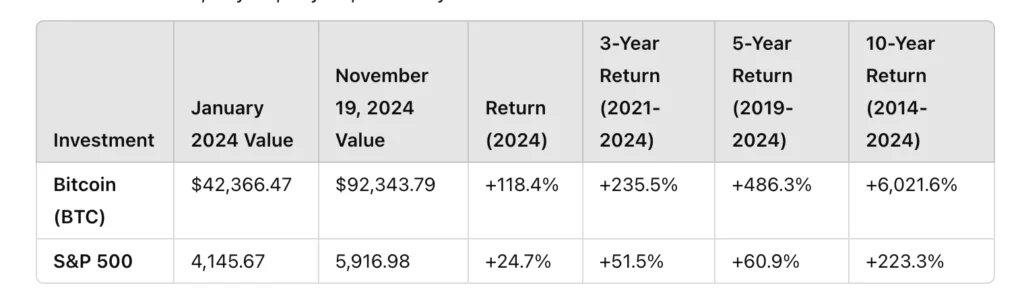

Bitcoin vs. S&P 500: How They Stack Up

Still not convinced? Let’s compare the performance of Bitcoin to the S&P 500 over different timeframes—this year, the past 3 years, 5 years, and 10 years.

For those who don’t know, the S&P 500 is an index that tracks the performance of the 500 largest U.S. companies, providing investors with exposure to traditional stocks.

As you can see, over various timeframes, Bitcoin consistently outperforms the S&P 500, even during its most turbulent years. While the S&P 500 may offer stable growth over time, Bitcoin has delivered significantly higher returns, especially in periods of market uncertainty or volatility.

***Out of my four investment channels—real estate, stocks, startups, and crypto—Bitcoin has truly been the star performer in 2024. You can read more about it here.

Why DCA in Bitcoin? Why Not Other Altcoins?

While there are many cryptocurrencies available, Bitcoin remains the safest and most reliable option—especially for beginners or anyone looking to minimize risk.

Coins like Solana (SOL), Cardano (ADA), Ripple (XRP), and Dogecoin (DOGE) can offer high rewards, but they also come with increased volatility and risk. From personal experience, I’ve lost a significant amount investing in altcoins (you can read about it in another post). On the other hand, Bitcoin has consistently proven itself as a safer bet with stronger long-term performance.

If you’re just starting out and want to reduce risk while still having the potential for growth, Bitcoin is the smart choice.

Ready to Start? Here’s How You Can Set It Up:

Now that you’re convinced and ready to take the next step, let’s dive into setting up your daily Bitcoin investment!

Step 1: Sign up for a crypto platform supported in your country (e.g., Binance, KuCoin, or Coinbase).

Step 2: Fund your account.

Step 3: Set up your daily investment (you only need to do this once—then it’s all automated!).

I followed a quick video tutorial and had everything set up in just 5 minutes. I even shared the link with my brother and cousin, and they were able to set it up just as easily.

Basically, you can create an order to automatically buy $1, $5, $10, or any fixed amount of Bitcoin at your preferred intervals (daily, weekly, bi-weekly, or monthly). You can pause or adjust this order at any time. Plus, you can set a target ROI, and the platform will notify you once you reach that goal. If you’d like, you can even automate selling your Bitcoin once it hits your desired ROI.

For Binance:

Watch this video to learn how to set up your daily investment:

How to Set Up DCA on Binance

For KuCoin:

Here’s a step-by-step video on setting up a DCA Bot:

KuCoin DCA Bot Setup

For Coinbase:

Follow this video to set up your Bitcoin investment:

Coinbase DCA Setup

If you’re using a different platform, don’t worry! You can easily find how-to videos on YouTube to guide you through the process.

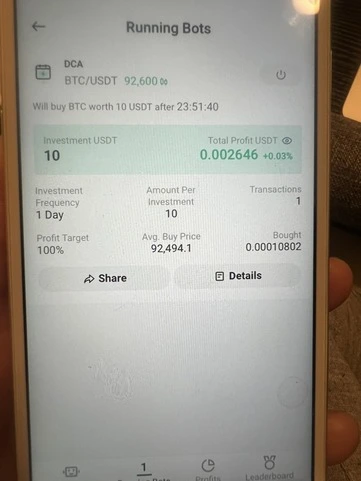

As For Me,

I started my DCA strategy today—even at Bitcoin’s all-time high ($92,494.10). I’m investing $10 daily and plan to stick with it for the long run. Here’s the proof! I’ll be updating my progress every six months, so be sure to check back for the latest results.

As For You,

Please invest what fits comfortably within your budget, and then forget about it. For me, $10/day is a manageable amount that doesn’t affect my lifestyle, regardless of whether Bitcoin’s price goes up or down. The beauty of Dollar-Cost Averaging is that it allows me to stay focused on the long-term, without getting caught up in the short-term market fluctuations.

Conclusion: Small Steps Lead to Big Rewards

Starting with just $1 a day might not seem like much, but through the power of Dollar-Cost Averaging, it can snowball into something substantial over time.

Whether you’re just beginning your crypto journey or you’re already an experienced investor, DCA offers a steady, low-risk way to build your portfolio while navigating market fluctuations. The secret? Consistency. Start small, stay consistent, and watch your investments grow.

If you decide to invest just a few dollars daily like I am, let’s check in on our progress together in 6 months, 12 months, and beyond. The long-term potential is where the real magic happens!

Related posts:

Offshore Companies & Tax Evasion (6 Chapters)

Offshore Companies & Tax Evasion (6 Chapters)

How to Invest in Cambodian Real Estate as a Foreigner: My Personal Experience as a European Investor

How to Invest in Cambodian Real Estate as a Foreigner: My Personal Experience as a European Investor

Real Estate Insights: My 2-Week Investment Journey in Ho Chi Minh City (Sept 2024)

Real Estate Insights: My 2-Week Investment Journey in Ho Chi Minh City (Sept 2024)

Why Cyprus is the Best Tax Haven in Europe for Expats in 2025: Low Taxes, High Benefits

Why Cyprus is the Best Tax Haven in Europe for Expats in 2025: Low Taxes, High Benefits

No Proof, No Problem: Top 5 Countries for Property Investment Without Financial Disclosure in 2025

No Proof, No Problem: Top 5 Countries for Property Investment Without Financial Disclosure in 2025

Vietnam Real Estate Investment 2025: Critical Risks, New Regulations & Insider Tips for Foreign Investors

Vietnam Real Estate Investment 2025: Critical Risks, New Regulations & Insider Tips for Foreign Investors