I’m writing this blog on my last day of a week-long trip to Phnom Penh, Cambodia, where I explored the dynamic Cambodian real estate market and met with several trustworthy real estate agents specializing in foreign property investment. I can’t wait to share my insights and experiences with anyone who’s interested in investing in Cambodia but hasn’t taken the plunge yet. Hopefully, this blog will provide you with the valuable information you need to make an informed and confident decision.

I’ve always been keen on international real estate investments. You can read more about my motivations and journey in this blog post. As I expanded my portfolio geographically, Cambodia emerged as a fascinating option, showcasing rapid development and untapped potential. Over the past decade, the country has transformed from an agriculture-dependent economy to one driven by garment and footwear manufacturing, construction, and services. Major global brands, including Adidas, H&M, and Nike, are known to manufacture products here. In fact, I’ve noticed that many of my own clothes and shoes are made in Cambodia—perhaps you have too!

To better understand the potential of investing in Cambodia, it’s crucial to understand the country’s demographics and the major changes that have shaped its economic environment.

Cambodia’s Demographics

- Population (2024): Approximately 17 million.

- Growth Rate: The population growth rate is around 1.4% per year, which is moderate compared to other Southeast Asian nations.

- Demographics: With over 30% of the population under the age of 30, Cambodia boasts a young and growing labor force poised to support continued economic development.

Between 2010 and 2019, Cambodia experienced impressive annual GDP growth rates averaging 7%, making it one of the fastest-growing economies in Southeast Asia. Although the global pandemic caused a slowdown in 2020, the economy has rebounded robustly, with growth rates of 5-6% annually from 2022 to 2024.

Transformative Changes in the Last 10 Years That Shaped Cambodia’s Real Estate

Cambodia has undergone significant changes in recent years, driven by several key factors:

- Urbanization: Rapid urbanization, especially in Phnom Penh, has spurred remarkable real estate development. The city now features a growing number of high-rise condos, shopping malls, and office buildings, largely fueled by foreign investment. You can read more on this report from the World Bank.

- Infrastructure Development: Major investments in infrastructure such as roads, airports, and railways have improved Cambodia’s connectivity, especially through Chinese-backed Belt and Road Initiative (BRI) projects. Sihanoukville has transformed into a major port and industrial hub.

- Tourism Growth: Before the pandemic, Cambodia experienced a tourism boom, driven by its historical landmarks like Angkor Wat. In 2019, the country welcomed approximately 6.6 million tourists. Sihanoukville emerged as a prominent resort and casino destination, bolstered by Chinese investment.

- Foreign Direct Investment (FDI): Significant FDI, particularly from China, South Korea, and Japan, has flowed into Cambodia. The construction and real estate sectors have been major beneficiaries of these investments.

- Political Stability: Under the long-standing rule of Prime Minister Hun Sen, Cambodia has maintained political stability, creating a favorable environment for foreign investment, although issues related to governance and corruption persist.

- Industrial Diversification: The Cambodian economy has diversified beyond agriculture to include manufacturing (mainly garments and footwear), construction, and services. Garment exports, especially to the EU and the U.S., have been a major growth driver.

If you take a closer look at Cambodia’s infrastructure and real estate development over the past decade, one thing stands out: Chinese investments have been a driving force behind much of the country’s transformation. From high-rise buildings to key infrastructure projects, the influence of Chinese capital has been unmistakable. Yet, as an investor eyeing Cambodia’s market, I’m left wondering about the significant shift that occurred when many Chinese investors began withdrawing during and after the COVID-19 pandemic. What brought them here in the first place, and why did they leave so suddenly?

Why Did Chinese Investors Come to Cambodia?

- Economic Opportunities and High Returns: Cambodia’s burgeoning real estate market, especially in Phnom Penh and Sihanoukville, attracted Chinese investors seeking high returns. With the Cambodian economy growing at approximately 7% annually before the pandemic, the environment was ripe for investment due to relatively low property prices compared to neighboring countries.

- Belt and Road Initiative (BRI): The BRI led to significant Chinese investment in Cambodia’s infrastructure, facilitating rapid urbanization. Projects financed by Chinese capital, including roads and energy plants, played a crucial role in transforming Phnom Penh and Sihanoukville.

- Liberal Investment Laws: Cambodia’s investment laws allowed foreign investors to own up to 70% of condominium units, and the absence of strict capital controls facilitated easy money transfers. This openness is a point I’ll revisit in my personal experience later!

- Tourism and Casinos: Sihanoukville’s emergence as a hotspot for Chinese tourists and investors, particularly in the casino industry, was driven by a growing influx of Chinese visitors. By 2019, over 90% of Cambodia’s casinos were Chinese-owned.

- Strategic Location and Political Stability: Cambodia’s proximity to China and its stable political environment under Hun Sen made it an attractive investment destination for Chinese businesses looking to enter Southeast Asia.

Why Did Chinese Investors Leave?

The exit of many Chinese investors raises several questions:

- Cambodian Government Crackdown: The 2019 ban on online gambling, a major industry for Chinese investors, led to a mass exit from Sihanoukville. The government’s crackdown, aimed at addressing issues like money laundering and human trafficking, prompted many investors to leave.

- Tensions and Backlash: The influx of Chinese investment caused local resentment in Sihanoukville, with rising property prices and job competition leading to complaints from residents. Increased crime rates and unregulated development further fueled discontent.

- Overdevelopment Concerns: Unregulated development in Sihanoukville resulted in environmental degradation, overcrowding, and strained infrastructure. The chaotic state of the town diminished its appeal for long-term investment.

- Pandemic Impact: COVID-19 severely affected Cambodia’s economy, including real estate and tourism. The pandemic’s impact led many Chinese investors to reassess their operations in the country.

- Economic Diversification: As China sought to diversify its investments and reduce reliance on specific sectors like gambling, some investors redirected their focus to other industries or countries.

Types of Real Estate Investments in Cambodia

Foreign investors in Cambodia have three primary real estate investment options, each with its own complexities in terms of setup and legal structure:

1. Residential Real Estate

Foreigners can legally own up to 70% of the units in a condominium project, provided that these units are located above the ground floor. The remaining 30% must be owned by Cambodian citizens or entities. Additionally, foreigners are allowed to own buildings on leased land, offering a flexible path to residential property ownership.

If you’re considering investing in residential real estate, the process is relatively straightforward. Partnering with a reliable local agent can be immensely helpful. They can handle most of the complexities, utilizing their local connections to navigate Cambodia’s often lengthy and intricate bureaucratic processes.

2. Commercial Real Estate

Opportunities in commercial real estate abound, including investments in office spaces, retail properties, or mixed-use developments. While this sector holds significant potential, it falls outside my area of expertise. Therefore, I cannot offer personal insights or advice on commercial property investments at this time.

3. Land Investment

Foreigners are generally not permitted to own land in Cambodia outright. However, through proper legal structures, it is possible to work around this restriction. Having a reputable and knowledgeable local agency is crucial for navigating this process. A good agent can help structure your investment in a tax-efficient way, providing guidance through each step

During my time in Cambodia, I was fortunate to meet an outstanding agent who has successfully helped many international clients acquire land and properties with ease. His expertise in maneuvering through the legalities was impressive. However, land investments typically require tying up capital for several years, waiting for the value to appreciate. This strategy doesn’t align with my current investment goals, which focus on more immediate returns, so I decided to pass on this opportunity.

***My General Observations***

In Cambodia, having money and the right connections can solve almost anything. So, make sure to leverage local experts to your advantage.

Taxation on Real Estate

From my own experience, the information I found online about real estate taxes in Cambodia often seemed less favorable compared to what I heard from local agents. That’s why I believe it’s always smart to consult with local experts—they can offer insights and strategies you simply won’t find on the internet.

As of 2024, there’s no capital gains tax on real estate in Cambodia, though it’s rumored to be coming by the end of 2026. The transfer tax is usually around 4%, but this can vary depending on the developer. Interestingly, while online sources mention a 20% capital gains tax for foreigners, all of the big agents I spoke to assured me there are ways to legally minimize or avoid these taxes.

Amazing Benefits of Living and Investing in Phnom Penh, Cambodia

#1. Dual Currency System: USD and Cambodian Riel

In Cambodia, you’ll find that the US Dollar (USD) is used alongside the Cambodian Riel (KHR) as the de facto national currency. This dual-currency system simplifies financial transactions, allowing residents and visitors to deposit, withdraw, and use both currencies seamlessly at ATMs and banks. Whether you’re buying street food or making significant purchases like real estate and vehicles, both currencies are widely accepted. The USD is particularly favored for larger transactions, including real estate deals, business investments, and government fees.

Why Does Cambodia Use Both Currencies?

The use of the USD in Cambodia dates back to the aftermath of the Khmer Rouge regime (1975-1979), which left the country in economic disarray with hyperinflation and a severely devalued Cambodian Riel. In the early 1990s, as part of its economic recovery, Cambodia adopted the US Dollar alongside the Riel to stabilize the economy and attract foreign investment. This strategy has proven successful, providing a stable currency environment that has supported the country’s reconstruction and growth.

Advantages for US Citizens and USD Earners

For US citizens or individuals earning in USD, Cambodia’s dual-currency system offers notable advantages. It simplifies transactions and investment processes, allowing you to hold and use your USD without worrying about currency conversion issues. This can be particularly beneficial if you’re looking to invest or manage finances outside the United States.

A European Parallel: Montenegro’s Currency Use

Interestingly, a similar situation occurs in Europe. Montenegro, although not a member of the European Union, uses the Euro (EUR) as its official currency. This arrangement helps stabilize the economy and facilitates international trade and investment, even without formal EU membership.

#2. Thriving Banking Sector

Phnom Penh’s vibrant banking scene is a compelling indicator of the city’s economic vitality. As you stroll through District 1, you’ll find an impressive array of bank branches on nearly every street, highlighting the dynamic financial environment of the city.

For a relatively small country, Cambodia boasts around 60 banks operating nationwide, a remarkable figure that reflects both international and local confidence in its economic prospects. This growing network of banks caters to the increasing demand for financial services, showcasing the country’s development.

The robust banking sector not only simplifies financial transactions for residents and investors but also underscores Cambodia’s broader positive economic trajectory. With so many banking options available, transactions are streamlined and user-friendly, making it significantly easier for anyone navigating the Cambodian financial landscape.

Interestingly, if you compare this to countries like Indonesia, Vietnam, Thailand, and the Philippines—each with populations several times larger than Cambodia’s—you’ll notice they have a much smaller number of banks operating there. This disparity further emphasizes the strength and potential of Cambodia’s banking sector.

#3. Simplified Financial Procedures for Foreign Investors

One of the most compelling advantages of investing in Cambodia is the straightforward approach to financial transactions and banking. In Phnom Penh, banks and project developers are typically more relaxed about the origin of your funds compared to many developed countries. Unlike in the EU or USA, where lengthy KYC (Know Your Customer) checks and extensive proof of income are standard—and sometimes result in rejections—the process in Cambodia is generally much more streamlined and user-friendly. To put it bluntly, they don’t really concern themselves with where your money comes from.

To open a bank account in Cambodia, you generally need a visa valid for at least six months. However, Cambodia’s evolving regulations as a developing country provide a level of flexibility not commonly found in more regulated environments. With a bit of charisma, the right connections, and sufficient financial means, you can often navigate these requirements with relative ease.

In practice, many expatriates and investors on tourist visas have successfully opened both KHR and USD accounts. While different banks may have varying requirements—some more stringent than others—there are always options available. For added convenience, property agencies can often arrange for bankers to visit you at your hotel, ensuring a smooth and efficient process.

#4. Attractive USD Fixed Deposit Rates in Cambodia

It’s a common expectation that savings accounts should yield positive interest. However, my experience has been quite different. In the Netherlands, I faced no to negative interest rates for many years, which meant I was essentially paying to keep my savings in the bank. I’m sure many Dutch readers can relate to this frustrating situation.

When I first read about the high fixed deposit rates available in Cambodia a few years ago, I was skeptical—it seemed too good to be true. However, upon visiting, I found that the reality matched the hype. Banks in Cambodia offer competitive fixed deposit rates on both USD and KHR, typically ranging from 4% to 5% for USD, KHR offers much higher rates. While some smaller banks may provide slightly higher rates, the larger, reputable banks generally stick to this range. Additionally, if you deposit larger sums, banks are often willing to offer even better rates. Prior to 2024, rates even reached up to 8.5% with certain banks.

For US citizens or those earning in USD seeking a secure investment, Cambodia’s fixed deposit options present a valuable opportunity. Many expatriates and retirees I’ve met during my stay in Phnom Penh have found that the interest earned from these deposits is often sufficient to cover their rent, which typically ranges from $500 to $1,500, and in some cases, even their entire living expenses.

#6. Still Possible to Find Property Investments Under $100K

While finding good property investments under $100K in Phnom Penh is becoming increasingly challenging, it’s still achievable. Foreigners are limited to purchasing condominiums, which often come with luxury price tags due to high-end amenities like swimming pools and recreational areas.

The recent departure of Chinese developers has left many unfinished buildings and projects across Cambodia, leading to diminished trust in new developments from that origin. This understandably makes both locals and investors more cautious.

Trusted Japanese Developers

In contrast, Japanese developer Tanichu Assetment Co. Ltd. has earned a solid reputation with successful projects like J-Village Apartment, J-City, J-Tower 1, and J-Tower 2. Their latest venture, J-Tower 3, has already sold over 80% of its units despite being recently launched and not expected to be completed until 2028. During my visit, I encountered around 50 Japanese businessmen specifically there to invest, highlighting their confidence in this developer. Following the presentation, many additional condos were reserved, further indicating strong demand.

However, Japanese projects tend to carry a steep price tag. For instance, a three-bedroom apartment in J-Tower 3 ranges from $320K to $425K. An agent estimated a modest rental yield of 7% and a potential 20% appreciation by 2028, which seems reasonable if Cambodia’s economy continues to grow. Payment terms are flexible, typically requiring a 20% down payment, followed by 30% in monthly installments, with the remaining 50% due upon completion. Early payments may also secure additional discounts, and these terms generally apply to projects from all developers.

While J-Tower 3 is an appealing project, its price exceeds my budget. For those with substantial capital seeking safe and diversified investment opportunities, it could be worth considering.

Affordable Alternatives

Another noteworthy developer is Megakim World Corp. Ltd., a Taiwanese company known for offering affordable yet high-quality condos. Their successful projects, including Time Square 1 through Time Square 5, have garnered attention. Time Square 6, set for completion in 2027, sold out within two months of its May 2024 launch, and Time Square 7 is already 80% sold out with a completion date in 2028. With $100K, you can purchase a one-bedroom apartment from this developer.

I’ve also reviewed several projects from Chinese developers. While they look promising on paper, their reputations lead me to pass on these options for now.

Exploring Land Investments

If you have the time, patience, and capital, exploring investments in houses and land could be worthwhile. Though it requires more setup and investment, you might uncover more lucrative opportunities and higher returns. Just be sure to conduct thorough research and consult local experts to navigate the complexities of the market.

#6. Exceptionally Friendly and Welcoming Locals

Another standout feature of living in or visiting Cambodia is the remarkable warmth and friendliness of the locals. Whether you’re at a market, hotel, restaurant, SIM card shop, or hailing a tuk-tuk, you’ll find people not only eager to help but genuinely kind. My friend who traveled with me, and I shared this impression, and many expats I’ve met—even those who previously lived in Thailand—echo the sentiment that Cambodians are exceptionally welcoming.

What truly surprised me was the high level of English proficiency among those in the (higher) service industry. From banks to SIM card companies and hotels, most locals speak enough English to ensure smooth and stress-free interactions. This is a refreshing contrast to neighboring countries like Vietnam, where English can sometimes be a barrier. It’s such a relief to navigate daily life without struggling to communicate, especially when the person assisting you does so with a warm smile, making you feel right at home.

Reflecting on my previous travels to places like Georgia and South America, I recall how challenging it could be to engage with locals while relying solely on English. In Cambodia, the combination of strong English skills and genuine friendliness makes accessing services not only easier but also far more enjoyable.

#7. Walkable, Budget-Friendly, and Packed with Great Food

Phnom Penh’s city center is remarkably walkable, making it easy to explore on foot. Just be prepared for the heat and humidity—especially during the day, when a 5-10 minute walk can leave you drenched in sweat. Thankfully, the evenings bring cooler temperatures, transforming your stroll into a delightful experience as you soak in the lively streets and vibrant local atmosphere.

Another great surprising aspect of Phnom Penh is its affordability. During my week-long stay, I spent less than $100 on food, drinks, and dining out—making it the most budget-friendly trip I’ve ever taken. For budget travelers, expats, and digital nomads, Phnom Penh offers an excellent standard of living without straining your finances.

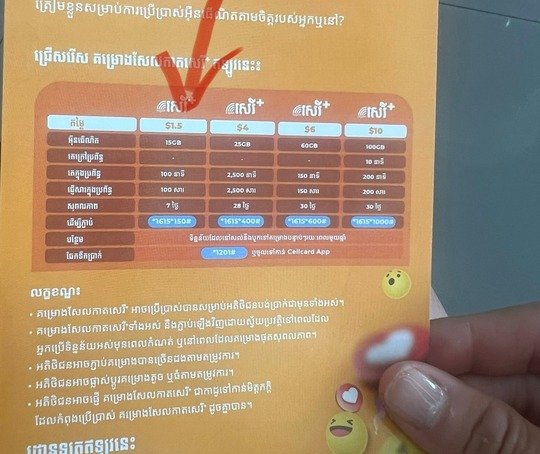

Speaking of great deals, I picked up a local SIM card with 15GB of data for just $2.50 ($1 for the physical sim and $1.5 for the data)! It’s a testament to how cost-effective daily life can be here.

Phnom Penh’s Unique Disadvantages for Real Estate Investment

While Phnom Penh presents numerous opportunities for real estate investment, it also has its share of challenges. Here are some key disadvantages to consider:

- Smaller Market and Population

With a significantly smaller population compared to major Southeast Asian countries like Thailand, Indonesia, The Philippines, and Vietnam, Phnom Penh’s real estate market has lower demand. This can lead to slower property price appreciation and less attractive rental yields, making it less appealing for investors seeking rapid growth and high returns. - Limited Entertainment and Activities

As a relatively small city, Phnom Penh offers fewer entertainment options. After just a couple of days, I found myself running out of activities to explore. If you thrive in bustling social scenes or enjoy a wide variety of recreational opportunities, you may find the city’s offerings lacking. - Scarcity of Green Spaces

One aspect I personally miss is the limited number of parks and green spaces. For many, access to natural surroundings is essential, and Phnom Penh does not provide ample opportunities for leisurely walks in green environments. - Competitive Real Estate Market

The rapid development of high-rise condominiums has saturated the Phnom Penh real estate market. With numerous new projects launching, competition to rent or sell properties at a premium has intensified, making it more challenging for investors to achieve their desired returns. - Unfinished Projects and Economic Uncertainty

The presence of many unfinished buildings, coupled with the exodus of Chinese developers, raises concerns about the long-term economic stability of Phnom Penh. This oversupply of abandoned or stalled projects can undermine confidence in the property market’s sustainability. - Widespread Corruption

Corruption is deeply embedded in Cambodia’s political and economic systems. Prime Minister Hun Sen’s over three-decade rule has created a system of patronage where high-ranking officials promote family members and loyalists to key positions. This network perpetuates control and allows corruption to thrive at all levels of governance. Bribery is common, particularly when navigating the bureaucracy. Whether it’s obtaining a driver’s license or securing land titles, citizens often have to pay bribes to access even basic services. Businesses, too, face similar obstacles, having to provide kickbacks to win contracts or regulatory approvals.

According to Transparency International’s Corruption Perceptions Index, Cambodia consistently ranks poorly, placing 150 out of 180 countries in 2022. This level of corruption undermines economic development, deters foreign investment, and leads to the inefficient use of public resources, further stalling the country’s progress in key areas like infrastructure, healthcare, and education.

My Own Verdict

In my view, the real estate options for foreigners in Phnom Penh are limited with a heavy concentration in the Boeung Keng Kang (BKK 1) area, the city’s vibrant heart. The rapid rise of high-rise buildings has led to an oversupply of apartments, leaving many units vacant. Combined with the local government’s ineffective urban planning and pervasive corruption, these factors raise substantial concerns for potential investors like myself.

As someone interested in buying, renovating, and listing properties on Airbnb or for long-term rentals—specifically targeting higher-income tourists, expats, and digital nomads—I find the competition fierce. The continuous influx of new developments complicates efforts to stand out. Additionally, the close proximity of these high-rises and the lack of regulatory oversight only heighten my reservations.

On a more positive note, I recently discovered a project that has caught my interest, and I’m carefully weighing my options. I especially appreciate the flexible payment plan—just a 20% down payment, followed by 30% spread over three years until completion. The remaining 50% is due only after the project is finished and legal ownership is transferred. This structure provides an opportunity for potential appreciation during the three-year period, offering the possibility of a quicker sale if market conditions are favorable.

For those new to international real estate investing, I would not recommend Cambodia as a first choice. The risks and returns may not justify the stress and anxiety for first-time investors. However, for seasoned investors looking to diversify their portfolios or those with substantial cash reserves, Cambodia presents intriguing opportunities. The potential for premium bank accounts and attractive USD fixed deposit rates—often exceeding 5% annually—adds to the appeal, along with various other financial benefits.

Ultimately, I have strong faith in Cambodia’s growing economy and the real estate development landscape in Phnom Penh. With careful consideration and strategic planning, there are still great opportunities to be found that can yield decent rental income and appreciation. Stay tuned for my coming updates.

Related posts:

Real Estate Insights: My 2-Week Investment Journey in Ho Chi Minh City (Sept 2024)

Real Estate Insights: My 2-Week Investment Journey in Ho Chi Minh City (Sept 2024)

Offshore Companies & Tax Evasion (6 Chapters)

Offshore Companies & Tax Evasion (6 Chapters)

How to Start Investing in Crypto with Just $1: A Beginner’s Guide

How to Start Investing in Crypto with Just $1: A Beginner’s Guide

Nairobi Real Estate Investment 2025: How I Bought 2 High-ROI Apartments for Under $150K

Nairobi Real Estate Investment 2025: How I Bought 2 High-ROI Apartments for Under $150K

Nairobi Real Estate Investment Risks (2025): What Every Investor Must Know

Nairobi Real Estate Investment Risks (2025): What Every Investor Must Know

Vietnam Real Estate Investment 2025: Critical Risks, New Regulations & Insider Tips for Foreign Investors

Vietnam Real Estate Investment 2025: Critical Risks, New Regulations & Insider Tips for Foreign Investors